3 Smart Tax and Investment Moves for Turbulent Times to Thrive Amid Uncertainty

KEY TAKEAWAYS:

- Maintain and adjust your portfolio strategically by regularly rebalancing to stay aligned with your risk tolerance and reassessing your asset allocation to reflect changing market conditions and personal circumstances.

- Tax-loss harvest to offset capital gains and reduce taxable income, while carefully navigating the IRS wash-sale rule to maximize potential benefits.

- Capitalize on market downturns with Roth conversions, allowing you to transfer assets into tax-free accounts at lower valuations and potentially increase long-term tax-free growth without bumping into higher tax brackets.

Uncertainty is a constant in life, but today’s economic and market landscape presents an especially complex set of challenges for retirees and those nearing retirement. Market volatility, inflation, and unknown tax policies can make it difficult to feel confident about the future of your retirement plan. However, opportunities exist within this environment.

As retirement planning specialists, we are currently talking to clients about considering strategies like discounted Roth conversions, tax-loss harvesting, and disciplined rebalancing. These can help you manage risk, reduce your taxes, and strengthen the long-term efficiency and resilience of your retirement plan. Let’s look at how to put these three key strategies to work during uncertain times.

1) Rebalance Your Portfolio

Rebalancing involves selling investments that are overweight in relation to their target allocation and using the proceeds to buy the investments that are underweight. The goal is to ensure your portfolio's risk stays aligned with your risk tolerance. Check out our insight on how to determine a proper asset allocation for retirement here.

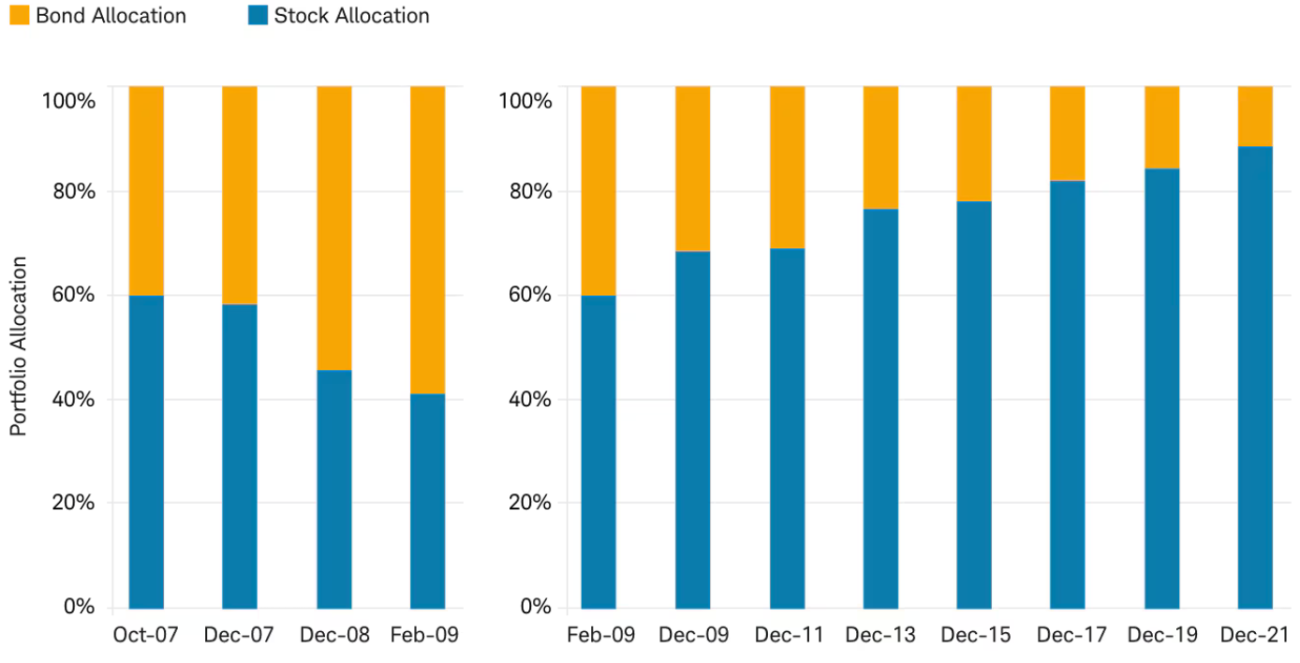

In the image below, we can see how a 60% stock and 40% bond portfolio would have drifted to approximately 40% stocks and 60% bonds during the financial crisis (Oct-07 through Feb-09) and how the same 60% stock and 40% bond allocation would have drifted to approximately 90% stocks during the ensuing bull market (Feb-09 through Dec-21) in the absence of rebalancing. This results in a portfolio that is either too conservative and unable to benefit from the market rebound fully, or too aggressive, which can overexpose you to market gyrations.

Rebalancing Can Lower Risk in Your Portfolio

Source: Schwab Center for Financial Research with data from Morningstar, Inc.

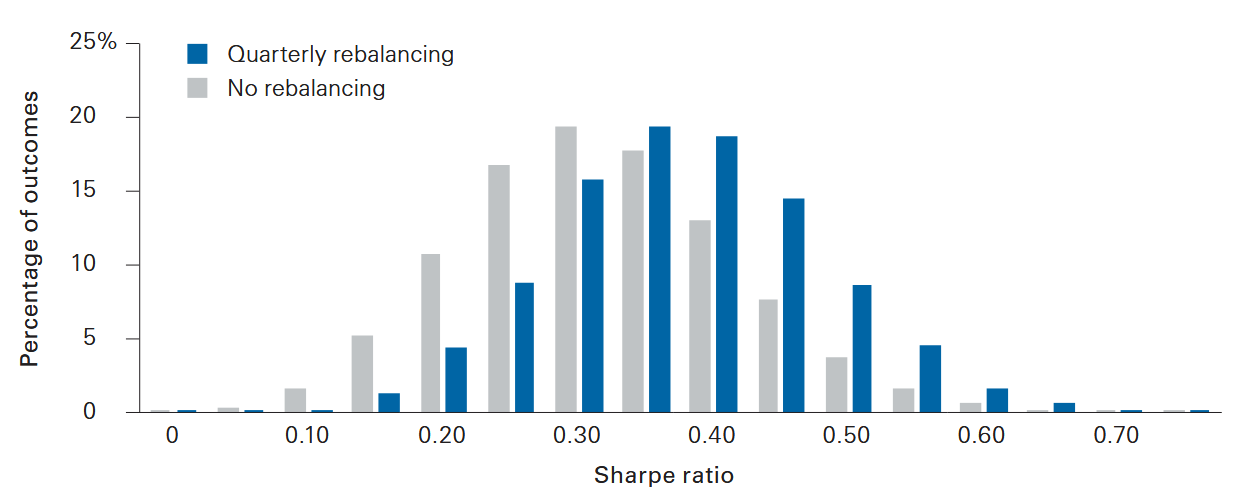

Research by Vanguard also suggests that rebalancing can increase risk-adjusted returns, which considers the risk taken in order to achieve the return. While there are different ways to measure risk-adjusted returns, Vanguard’s study looked at the widely used Sharpe Ratio (the higher the Sharpe Ratio, the better).

How Rebalancing Improves Risk-Adjusted Returns

Source: Vanguard

How often should you rebalance?

Rebalancing shouldn’t be done too often or too infrequently. Quarterly, semi-annually, and annually, all work well. So, just pick a frequency that you can stick with.

To reduce or even eliminate the tax implications, consider rebalancing in your retirement accounts instead of your taxable brokerage accounts. This can be done by viewing your asset allocation at an aggregate level (across all your accounts) rather than at an account level.

Additionally, consider using cash flows, such as contributions and dividends, to perform “mini” rebalances throughout the year. Lastly, be cautious of rebalancing during times of high market volatility, as large market swings can quickly throw your allocation back out of alignment.

Sell Legacy Holdings

Many of our clients have investments they want to sell, but they’re holding onto them because they have a significant embedded capital gain and wish to avoid a large tax bill. If you are in a similar situation, now may be a good time to sell shares of your legacy holdings if they’ve declined in value.

Revisit Your Asset Allocation

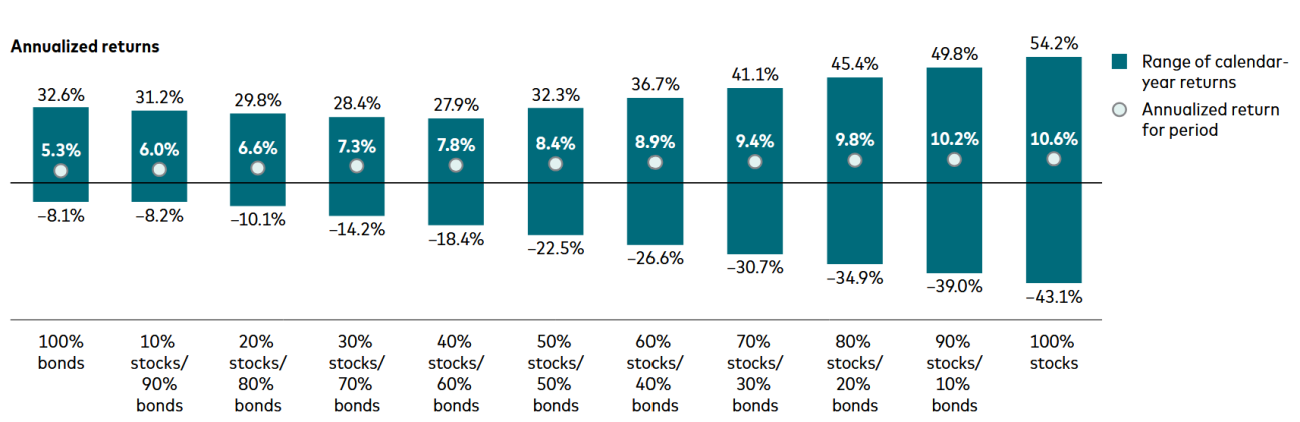

Real-world market conditions are far more effective at helping you determine your risk tolerance than some arbitrary questionnaire. So if you’re feeling uneasy, it’s a great time to revisit your asset allocation to ensure it's still appropriate for your risk tolerance. After all, risk tolerance can change. Being employed and contributing to your 401k during the financial crisis in 2008-2009 would have felt much different than if you were retired and withdrawing from your portfolio, so consider how your circumstances have changed since you last chose your asset allocation.

Asset Allocation Defines Investment Return Variance

Source: Vanguard (January 1, 1926 through December 31, 2021)

While the overall mix of stocks versus bonds drives most outcomes, the sub-asset classes (e.g., US stocks, European stocks) within your portfolio matter, too. A globally diversified portfolio that includes international stocks will help dampen volatility, so if your portfolio is concentrated in US stocks, now is an excellent time to trim some of the gains you’ve accumulated over the past decade and diversify overseas (we use Vanguard European, VGK, and Pacific Stock, VPL, in our portfolios).

Additionally, yields remain attractive. Consider setting up a fixed-income ladder to pre-fund your near-term spending (spending within the next three years or so) or extend your existing ladder (we typically use individual U.S. Treasuries or CDs in our clients’ portfolios). Doing so will help you tune out some of the market noise.

2) Tax Loss Harvest

Simply put, tax loss harvesting is a way to turn your capital losses into tax savings. This is done by selling investments within taxable brokerage accounts that have a loss and immediately reinvesting the proceeds in similar investments, making sure to avoid the “wash-sale rule.” Any capital losses you realize in a given year can be used to offset capital gains, and up to $3,000 of excess capital losses (that exceed your capital gains) can be used to offset ordinary income.

Let’s assume you’re in the 35% federal tax bracket (taxable income of ~$250k-$626k for single and ~$501k-$751k for married) and have a 4.25% state rate (our home state’s rate) for a combined 39.25% tax rate. If you had $7,000 of capital gains and $10,000 of capital losses, your losses would offset your gains, and the $3,000 excess would offset ordinary income from sources like wages and dividends. This equates to a $2,494 tax savings ($7,000 x 18.8% capital gains tax rate = $1,316 + $3,000 x 39.25% ordinary income tax rate = $1,178).

A Potential Double Dip

Avoiding the IRS wash sale rule is crucial for successful tax loss harvesting. This rule prohibits selling an investment at a loss (for tax benefits) and then reinvesting in the same or a similar security within a 30-day period. To get around this tax loss harvest rule, use a replacement investment that’s close enough to the original investment. Within the context of ETFs and mutual funds, this replacement is referred to as a “swap fund.”

For example, using the Vanguard S&P 500 ETF (VOO) to replace the Vanguard Total Stock Market ETF (VTI) is a suitable swap fund. If VOO (the swap fund) incurs a capital loss after 30 days of ownership, it can be sold to realize the loss, and the proceeds could be reinvested in the Total Stock Market ETF (VTI). Hence, there is a possibility of realizing a capital loss twice.

3) Do a Roth Conversion

Roth conversions are a great way to hedge against future tax rate increases by shifting investment growth into tax-free Roth accounts. When stock valuations fall, Roth conversions “go on sale” because a retiree can convert a larger percentage of their pre-tax retirement account without entering a higher tax bracket.

For example, John and Mary want to convert $200,000 of Mary’s $2M traditional IRA to a Roth IRA this year, which would keep them in the 24% federal tax bracket. If she converted at the start of the year, she would have moved 10% of her IRA into her Roth. But if she waited to convert later in the year, after a stock market decline reduced the value of her IRA by 15%, she would have been able to convert 11.8% of her traditional IRA instead, and the amount of taxes owed for the conversion would be the same.

If you plan to convert to a Roth IRA this year, now may be a good time to do so, either in full or in part. In practice, we prefer to split Roth conversions into multiple transactions throughout the year (e.g., during Q1 and Q4) to balance maximizing tax-free growth with flexibility to adjust the strategy.

If you’d like to discuss how to strengthen your retirement plan during uncertain times, get in touch with one of our retirement planning specialists and get your Complimentary Thrive Assessment here.