The Roth conversion mistakes we see even savvy retirees make and how to avoid them.

Read More

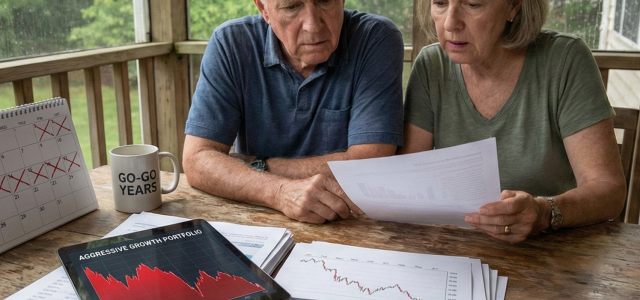

The risks of retiring with a more aggressive portfolio and what it could mean for your retirement income.

Read More

Even though retirement rules of thumb can change, here’s why many advisors still stick to outdated models.

Read More

Most retirees focus on the downside of risk. But the upside can be just as powerful.

Read More

How can you reduce the risk of running out of money even if you retire during the worst possible time?

Read More

These are the four consequences you might face if you try to apply the DIY approach to your retirement planning.

Read More

Have you become part of an advisor’s client segments without even knowing it? Here’s how this practice could impact your financial outcomes and goals.

Read More

Have you tried to Google yourself lately? Here’s how to protect your data and your nest egg from hackers.

Read More

Use this framework to effectively manage the most common financial risks to your retirement.

Read More

How much of your retirement lifestyle is it really costing you when you pay an advisor a percentage of your portfolio?

Read More

Despite the risk, less than 8% of Americans have long-term care insurance, opting to “self-fund” instead. Can you?

Read More

Guardrail strategies that rely on withdrawal rate, like the popular Guyton-Klinger, are problematic in practice. Focus instead on total risk.

Read More