The 60/40 Portfolio is Alive and Well

KEY TAKEAWAYS:

- The 60/40 portfolio has long been considered the "goldilocks" portfolio.

- Converging correlations between stocks and bonds over the past few years have left many wondering if the magic of a 60/40 is gone.

- Bonds are set up beautifully to bring the magic back to the 60/40 portfolio.

As retirement planning specialists, one of the many things we help clients with is ensuring that their portfolio is invested in a way that helps them achieve their goals while reducing risk.

When trying to figure out how to invest their retirement portfolio, many people come across the concept of the tried-and-true 60/40 portfolio, with a 60% stock/40% bond allocation. For many years, this has been known as the go-to diversified portfolio to optimize returns while minimizing volatility on the risk/return curve.

In 2022, this portfolio allocation would’ve lost 17%, its worst performance since at least 1937. Plus, stocks and bonds have moved in tandem more from 2019 to 2022 than at any time since 1997. So the big question is, does this portfolio allocation work even now, in 2025?

What’s the Magic of a 60/40?

Let’s start by exploring why the 60/40 portfolio is so popular and powerful for retirees seeking a diversified portfolio.

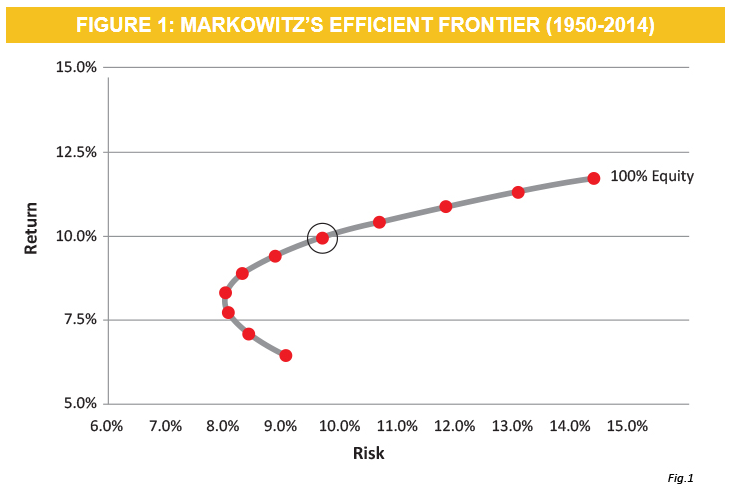

Figure 1 shows a portfolio composed of the Barclays Capital Aggregate Bond Index and S&P 500 Index allocated in 10% portfolio increments using average standard deviations (indicated on the chart as risk) and returns over the 65 years from 1950 to 2014. The circle indicates the point at which the portfolio is invested in 60% equity (or stocks) and 40% bonds.

Risk for the 60/40 portfolio is slightly more than a 100% bond portfolio, but the annual return has increased from 6.47% for the 100% bond portfolio to 9.95% for the blended approach, indicating a considerably more efficient portfolio in terms of risk and return. This is why many people seeking a diversified portfolio but not wanting to take on too much risk end up choosing the 60/40 balanced portfolio.

Figure 1 shows that Harry Markowitz’s efficient frontier still holds true 60 years later. (Harry Markowitz was the Nobel-winning pioneer of Modern Portfolio Theory.)

Why Had the 60/40 Failed in 2022? AKA Stocks and Bonds Correlation Examined

The magic of a 60/40 portfolio depends on stocks and bonds being negatively correlated, meaning their prices move in opposite directions (i.e., when stock prices fall, bond prices rise, and vice versa).

While far more complicated in reality, the basic theory is that when the economy is growing and healthy, the Federal Reserve must periodically raise rates to keep the economy from growing too fast and becoming inflationary. When rates go up, the value of bonds go down. But every economic expansion meets a peak and usually ends in recession. During a recession, stock values fall substantially as the outlook for company earnings decreases.

At this same time, the inflation risk diminishes, allowing the Federal Reserve to lower rates in an effort to spur economic growth. When interest rates fall, bond values increase. The best part is that bond values increase precisely when you need them to the most (when stock values fall and prices are “cheap”).

Economic cycles had been anything but ordinary after the Great Recession (2008-2009) when the Federal Reserve drove interest rates down to near zero. The Federal Reserve kept them there until the first quarter of 2022. By this time, inflation pressures had been building globally and then exploded as pent-up COVID-19 demand met a constrained labor market and supply chain, leading to a surge in prices. As if this was not enough, Russia invaded Ukraine in February of 2022, sending fuel and food prices even higher.

In an effort to combat inflation that reached its highest level since 1982 (at 8.5%), the Federal Reserve moved forcefully, raising rates 11 times at the fastest pace in four decades, bringing them to a 22-year high of 5.50%. Unfortunately, stocks and bonds were both casualties. Stocks because investors feared the aggressive rate action would send the economy into a recession, and bonds because they drop in value when rates rise. At this point, it looked to investors as if there was no longer such a thing as a diversified portfolio!

The Magic of a 60/40 is Back!

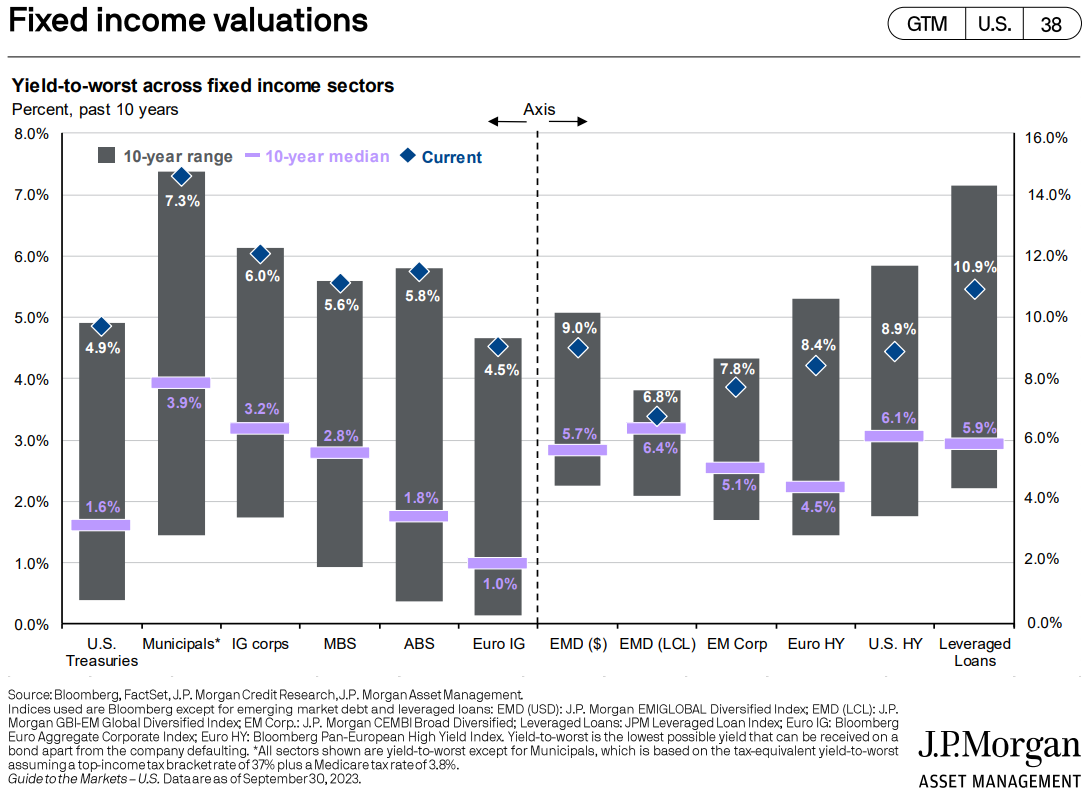

While painful getting here, the good news is that bonds are set up beautifully to serve as they generally do in a 60/40 portfolio when the economy is near a peak, with 10-year treasury yields just off their recent peak of 4.8% at around 4.3% as of July 2025.

Today, with yields where they are now and stocks experiencing a positive year so far in 2025, the data still shows that bonds have the power to hedge during periods of slower growth. Through April 30, 2025 the correlation between stocks and bonds has been at about 0.3 for the trailing 12-month period.

The beauty of the 60/40 approach isn't that it never loses money – it's that it provides a reasonable path to long-term wealth building without requiring you to make perfect timing decisions or pick winning investments. In a world full of complex financial products and conflicting advice, that simplicity has real value.

If you’re not sure about the optimal allocation to reach your financial goals and want help reviewing your portfolio to make sure you're positioned well for retirement, our team of retirement planning specialists is here to help. Click here to schedule an informal, introductory Zoom call to get started.