Aim Higher Than "Not Running Out of Money" – Is Your Safe Withdrawal Rate Costing You Money and Quality of Life?

Key Takeaways:

- Traditional safe withdrawal strategies are overly conservative and often lead retirees to underspend, leaving behind more money than necessary at the cost of missed life experiences.

- Planning based only on worst-case scenarios ignores the majority of better outcomes, resulting in lower quality of life during retirement despite having sufficient assets.

- A dynamic, reality-based approach using an optimal withdrawal rate helps retirees adjust over time and enjoy a higher standard of living while still managing long-term risks.

Have you ever wondered if you're being too conservative with your retirement withdrawals? You've saved diligently for decades, built a solid nest egg, and now you're ready to enjoy the fruits of your labor. But the problem with traditional retirement planning is that its analysis is static and does not allow for adjustment based on what’s actually happened.

This limiting issue is the reason the goal of traditional retirement planning has always focused simply on not running out of money. To accomplish this goal, traditional retirement planning seeks to find an individual’s “safe withdrawal rate.”

A safe withdrawal rate is the highest withdrawal rate an individual can sustain that could pass all possible investment market scenarios within the research’s scope. In other words, how much can I take from my portfolio every year (with an inflation adjustment) without risking running out of money? This is why the outcome of traditional retirement planning is always stated as a probability of success or failure. (See our Insight entitled “Retirement Can’t Be Pass or Fail” for more)

This insight explores why the traditional safe withdrawal rate approach is fundamentally flawed and how you can move from simply "not running out of money" to truly maximizing your retirement years.

Traditional Retirement Planning Focuses Only on Downside Risk

While the predictability of using a “safe withdrawal rate” may sound desirable at first glance, this approach is way too conservative. As retirement planning specialists, we often see that many clients end up leaving far too much money on the table upon passing that could have been used to increase your quality of life during retirement should your actual investment market scenario end up better than the very worst that history could turn up.

Consider what this means in practical terms. If you follow a rigid safe withdrawal rate, you're essentially betting that your retirement will unfold exactly like the Great Depression era or the stagflation period of the 1970s. While these periods certainly happened, they represent extreme outliers, not typical experiences.

Traditional retirement planning only cares about the worst possible outcomes and ignores all the better (and mathematically more probable) outcomes. It has to do so because the approach taken in traditional retirement planning cannot adjust and incorporate reality. This approach has no choice but to assume and protect against the worst. Yet this often ignores the important real-life question of mortality and enjoying the maximum quality of life while we are alive. We, of course, understand that many clients have a desire to leave some sort of legacy to their children, grandchildren, or charities, but even with this planned gifting taken into account, we see too many of them sacrificing the life they want to live to then end up with more money than they planned on. On the surface, this may seem like a good problem to have, but if you dig deeper and consider the life experiences that have been left on the table, the quality of life trade-off presents a real challenge.

Don't Leave So Much Money on the Table: How Much Could You Be Leaving Behind?

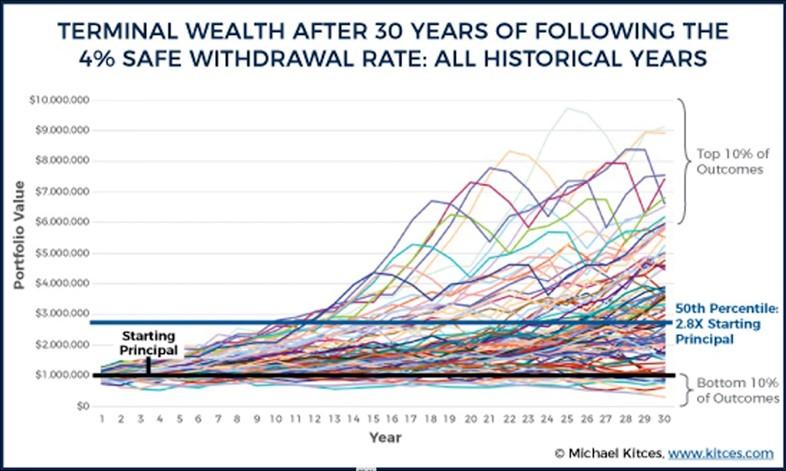

Michael Kitces, MSFS, MTAX, CFP, CLU, ChFC (www.kitces.com) produced this wonderful chart based on his research that illuminates just how much could be left on the table following a hypothetical 4% safe withdrawal rate “rule of thumb”:

In this example, a person begins with $1,000,000 and plans for a 30-year retirement. This person’s beginning withdrawal would only be $40,000 (4% x $1,000,000). Experiencing anything better than one of the bottom 10% of Monte-Carlo modeled investment market scenarios would leave this person with more money than when they started.

Further, you can see the 50th percentile (or median) modeled observation would leave this person with 2.8x what they had when they started (or $2,800,000). Unfortunately, and all too often, this person might not have taken that vacation to Europe, helped a loved one, donated to a charity, bought that RV, or picked up that restaurant check when in fact, they could have all along.

The only person that wins here is the traditional financial advisor, who charges based on the size of your portfolio that may actually continue to grow. This conflict of interest, along with lack of knowledge or initiative (aka "fat, dumb, and happy"), is why the retirement planning industry has failed to evolve even though time-tested research and principles have long existed to be able to do so. (See our Insight entitled “Why a Flat-Fee Advisor is Best for Retirees” for more)

Maintain Maximum Quality of Life During Your Retirement

Rather than looking for your safe withdrawal rate, we should look for your optimal withdrawal rate. Your optimal withdrawal rate aims to maximize your level of spending (i.e., quality of life, however you choose to spend/gift) while living during retirement and is dependent on many factors, including:

- Income (including Social Security claiming strategy)

- Assets (both financial and non-financial)

- Risk profile

- Asset allocation

- Portfolio construction and cost

- Level of tax planning

- Willingness and ability to be flexible in level of spending

- Level of risk management employed

Your optimal withdrawal rate will and should adjust as reality is incorporated as you progress down the path of what could be a 30-plus-year retirement.

Finding and maintaining your optimal withdrawal rate is one of the key objectives of our “reality-based” approach to retirement planning. While we go to great lengths to manage the downside risks (i.e., bottom 10% of modeled investment market scenarios), we also take great care and pride in helping you make the most of the other 90% of better possible scenarios. The primary way we achieve this goal is through the use of dynamic withdrawal rules and ongoing monitoring. (See our Insight entitled "Quantifying the Value of Dynamic Withdrawal Rules" for more)

Being a flat-fee financial advisor, our only interest is in seeing our clients make the very most of their retirement every step of the way.

If you would like help finding your optimal withdrawal rate, you can schedule a free consult with one of our retirement planning specialists here.