Can Direct Indexing Add Value to My Retirement Portfolio?

Key Takeways:

- Research shows that over time, active strategies often fail to consistently outperform simple index funds.

- Direct indexing offers personalized investment options but introduces more complexity, higher costs, and active management risks over pure index investing.

- For most retirees, sticking with low-cost, pure index funds is a more effective and less complicated approach to building a retirement portfolio.

As retirement planning specialists, we often get asked about which investment types and strategies are best for a retiree’s portfolio. One of the concepts that clients ask about includes direct indexing, an offshoot of index investing. Here, we explain what both index investing and direct indexing are and how they work.

What is Index Investing and How Did It Start?

Index investing is a passive investment strategy where an investor seeks to replicate the performance of a specific market index (like the S&P 500) by holding all or a representative sample of the securities in that index, aiming for broad market exposure at low cost.

The idea of index investing was initially proposed in the Financial Analysts Journal by Edward F. Renshaw and Paul J. Feldstein in 1960. By 1971, a Wells Fargo’s Management Sciences unit successfully created the first index fund for institutional investors. It was not until 1976, however, that John C. Bogle (founder of The Vanguard Group) created the first index fund available to retail investors.

Over the past 50 years, index investing has taken the investment industry by storm as research and academic literature continue to prove that fund managers typically cannot consistently beat the market.

Why Index Investing Works VS Active Management

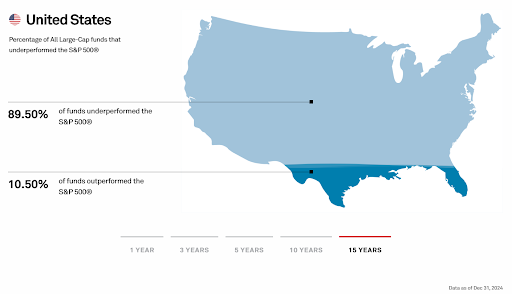

One of our favorite supporting resources to show the long-term underperformance of active management is the SPIVA® Scorecard, which has been conducted and published by S&P DJI over 20 years. It compares actively managed funds against their appropriate benchmarks on a semiannual basis.

Source: https://www.spglobal.com/spdji/en/research-insights/spiva/

While SPIVA® Scorecards change from period to period, two noteworthy themes have emerged.

- Actively managed funds have historically tended to underperform their benchmarks (especially over the long term). This has tended to hold true across different countries and regions.

- Even when a majority of actively managed funds in a category have outperformed the benchmark over one time period, they have usually failed to outperform over multiple periods.

Why pay more for active management if they can’t beat the benchmark you can hold for close to zero cost?

Ever since investors began broadly accepting index funds in the mid-1990s, mutual funds (and later Exchange Traded Funds, or ETFs) could be classified as either actively or passively managed. However, recent technological advancements and the advent of zero cost and fractional share trading have led for-profit financial companies to develop a new class of “index-based” products known as Direct Indexing, which introduce layers of active decision-making in the portfolio construction process, blurring the distinction between the two.

What is Direct Indexing?

Direct Indexing typically involves an investment manager directly purchasing the underlying securities of a chosen benchmark and holding them in a separately managed account (SMA) to try and earn pretax returns commensurate with those of the benchmark. The investment manager then overlays layers of active decision-making, such as the specific underlying securities, weighting strategies, and rebalancing methodologies to provide the end client with an array of customization points.

The Benefits of Direct Indexing

Providers of Direct Indexing argue that Direct Indexing embodies many benefits inherent in purely passive products but with greater opportunities for personalization.

Personalization can range from investing according to certain personal values, such as excluding specific companies or sectors (e.g., tobacco, fossil fuels) to align with personal or environmental, social, or governance (ESG) preferences or titling the portfolio toward desired factors like value, growth, or dividend yield.

Providers of Direct Indexing also promote that by owning individual securities, investors can harvest losses at the stock level, potentially offsetting capital gains and reducing tax liability more efficiently than with ETFs or mutual funds.

The Downsides of Direct Indexing

In exchange for these perceived benefits, you must also accept the following drawbacks:

Complexity

- Operational: Managing hundreds to thousands of individual securities requires sophisticated technology and professional management, introducing execution and decision-making error potential.

- Rebalancing: Ongoing rebalancing and tax-loss harvesting can be complex, also introducing execution and decision-making error potential.

- Administrative: More individual trades can mean more complex tax reporting for investors.

Cost

- Platform/Advisory Fees: A manager must be hired to manage the strategy at a cost exceeding that of owning a pure index fund.

- Trading Costs: Although many platforms offer commission-free trading, bid-ask spreads and market impact can add up, especially for less liquid stocks.

Risk

- Tracking Error (or deviation from the index): Customization and tax-loss harvesting can cause the portfolio to deviate from the target index, potentially resulting in performance differences.

- Manager Selection Risk: Results could vary from manager to manager, even following the same strategy.

So what’s the verdict?

The reality is that Direct Indexing is not really passive at all. As additional layers of human decision-making and execution are introduced, a passive investment strategy quickly becomes active.

What you end up with in Direct Indexing is active management but with slightly lower fees. While lower fees are good, we still know from research that active management is a tough game to win.

Skip Direct Indexing, Stick With Pure Index Funds

While there are some legitimate cases where Direct Indexing could make sense for a client, we feel the majority of pre-retirees and retirees would be best served by eschewing the added complexity, cost, and risk in favor of using traditionally constructed pure index funds when building their optimal investment portfolio..

Not sure which specific investment types and strategies would best help you achieve your retirement goals? Schedule a call with our retirement planning specialists and get a complimentary Thrive Assessment here.