Create a Retirement Withdrawal Strategy that Exploits Marginal Tax Rates to Save On Taxes

TAKEAWAYS:

- The real economic value of a dollar of savings depends on which type of investment account it is held in and how and when it will be taxed.

- Maximizing the after-tax value of your savings requires taking money from the right places and executing strategies at the right time.

- Material economic differences exist between withdrawal strategies and the most commonly recommended strategies tend to lead to the highest lifetime tax bills.

It's ironic that financial advisors and individuals spend so much time and energy on the accumulation side of the retirement planning equation, but when it's time to start living off those savings…..crickets. Yet the strategy you use to withdraw your assets can matter as much or more.

Financial advisors who charge based on the size of your portfolio don't want to see the assets leave when you retire. That’s why they tend to give overly conservative advice like, "live off the dividends and interest" or "let’s start at 4% and inflation adjust from there” (See our Insight entitled “Why a Flat Fee Advisor is Best for Retirees” for more), but never really recommend how to withdraw your retirement funds in strategic and sustainable manner.

Few individuals, even though they may be well-versed in investments and portfolio construction, have much of an idea of what to do either. Decumulation, or how to withdraw savings to fund retirement or what order to withdraw retirement funds, is just not something many people discuss or study.

A Dollar of Savings is Not Necessarily a Dollar of Savings

Without a retirement planning specialist on your side, you may have never even considered your retirement withdrawal order as something important. The problem is this is precisely where real retirement planning kicks in. So much value can be gained or lost when developing an optimal withdrawal strategy. You can easily see why when you stop to think about it. A dollar of savings is not necessarily all equal in real economic terms. The real economic value of a dollar of savings depends on which type of investment account it is held in and how and when you will have to pay taxes on it.

- For instance, a dollar of savings from a Roth account is truly worth a dollar because qualified withdrawals from your Roth are always tax-free.

- A dollar from your taxable (or brokerage) account may only be worth $0.85, $0.80, or $0.76, depending on your capital gains tax bracket, amount of gain, and when you take it.

- A dollar from your pre-tax retirement account (401k/IRA) can be worth as little as $0.50 if you made enough to be taxed at the highest possible State and Federal brackets and withdrew the savings during this time.

The point is that it’s the after-tax value of your savings that matters. So how do you optimize it so you can get the most out of your retirement funds?

How to Maximize the Value of Your After-Tax Savings

Maximizing the after-tax value of your savings requires taking money from the right places and executing strategies (like Roth conversions – See our Insight entitled “What Drives Value in a Roth IRA Conversion Strategy” for more) at the right time.

There are dozens of different withdrawal strategies: conventional wisdom, constant proportion, xx% bracket management, and so on. The problem is that no one strategy is optimal for the entirety of one’s retirement because too many events happen during retirement that will impact the level of your marginal taxation.

These events include:

- Claiming Social Security

- Instability of tax policy (the current Tax Cut and Jobs Act tax rates expire at the end of 2025 unless Congress is successful in extending it)

- Required Minimum Distributions (RMDs) will eventually force you to take taxable income from retirement savings

- Medicare IRMAA surcharges (based on income earned two years before starting Medicare)

- One spouse will inevitably be left in a “widow’s penalty” for at least some unknown time period

A retirement withdrawal strategy that maximizes the after-tax value of your savings is really a multiphase series of withdrawal strategies that navigate the potential increases and decreases in your marginal tax rates during these years when incomes can rise and fall. As you can imagine, this multiphase series of withdrawal strategies must be highly customized to each individual/couple.

The Secret to Optimizing Your Retirement Withdrawal Strategy

The key goal and value driver in your retirement withdrawal strategy is finding a way to fill the lower tax brackets during the beginning of retirement (when you’re most likely funding from your brokerage account) and throughout retirement (meaning you ensure you can claim just enough income to do so). It's about finding the “just right” balance based on what we know and then adjusting when the unknowable happens (changes to tax policy and rules).

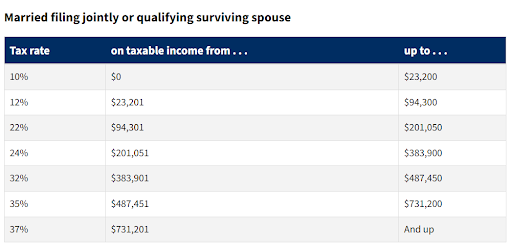

Based on the current tax brackets, a married couple may want to fill any gaps between their current tax rate and the next tax rate without getting them over that next tax bracket.

For example, if they are already in the 22% bracket because they have $100k of income from pensions and Social Security combined, then they could still take out money out of their IRAs (or even do a Roth conversion) up to a total of $201,050 without bumping up against the next tax bracket.

Source: https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Your Retirement Withdrawal Strategy Can Lead to Materially Different Economic Outcomes

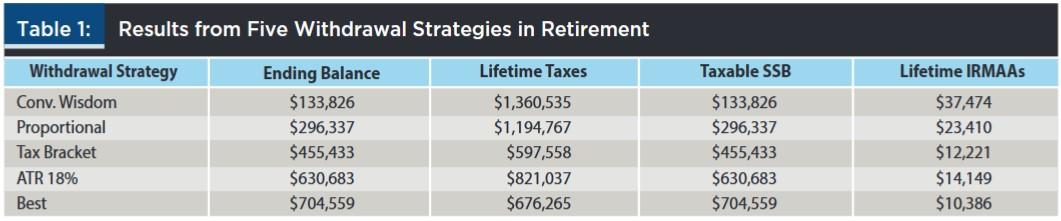

William Reichenstein, Ph.D., CFA, shares a case study in his column entitled “Why Multiphase Withdrawal Strategies Beat Single-Phase Withdrawal Strategies,” published in the Journal of Financial Planning in June 2023. In his case, a married couple had a financial portfolio worth $3 million and planned to spend an inflation-adjusted $13,000 monthly.

The table below shows his summary of outcomes using just five different withdrawal strategies (note, “SSB” stands for Social Security Benefit):

Clearly, there are material economic differences between these strategies. Unfortunately, the most commonly recommended withdrawal strategies (if one is recommended -- Conventional Wisdom and Proportional because of their ease) tend to perform the worst and leave retirees with a much larger lifetime tax bill than would be necessary with some better planning.

Understanding how each of these strategies works and figuring out the right retirement withdrawal order can be a complex task that should be completed with the guidance of a professional, such as a retirement planning specialist.

If you are ready to determine your optimal withdrawal strategy, we stand by ready to help. You can click here to schedule an informal introductory call to get started while receiving your complimentary Thrive Assessment.