Developing a Retirement Income Strategy to Minimize Lifetime Taxes

KEY TAKEAWAYS:

- An optimized retirement income strategy can significantly reduce lifetime taxes, often saving retirees hundreds of thousands of dollars compared to following the standard withdrawal order.

- Coordinating withdrawals across taxable, tax-deferred, and Roth accounts while considering current and future tax brackets can keep retirees in lower marginal tax ranges and increase after-tax income throughout retirement.

- Taking action before the current tax rates change could make a meaningful difference in your after-tax retirement income, especially for those with significant balances in pre-tax accounts.

For most financial advisors, retirement planning begins and ends with a “determination” of how much one can sustainably spend from their investment portfolio given a certain probability of success based on Monte Carlo Analysis. However, as retirement planning specialists that have helped hundreds of people design sustainable retirement income strategies, we believe this kind of retirement planning is far too basic and limited. For beginners, spending sustainability should be tested by Historical Simulation Analysis in addition to Monte Carlo Analysis because both approaches have their pros and cons. Further, most financial advisors lack the understanding of and ability to model the application of dynamic withdrawal rules. The application of dynamic withdrawal rules is, in most cases, the single most powerful tool we have in our tool chest as retirement planning specialists (see our Insight entitled "Quantifying the Value of Dynamic Withdrawal Rules" for more).

Nevertheless, the end goal of spending sustainability analysis is to determine how much someone can withdraw from their portfolio without taking on too much risk or running out of money.

But even that’s not the full picture. Once you’ve determined how much you can sustainably spend, the next (and often overlooked) step is figuring out how to structure your retirement income in a way that minimizes taxes over your lifetime. Because in retirement, how and when you withdraw your money can make just as much of a difference as how much you withdraw.

What is a Retirement Income Strategy?

A retirement income strategy is simply a plan for which accounts you take money from and when. The goal of a well-designed retirement income strategy is to help you reduce the total taxes you’ll pay throughout your retirement.

Of all the strategies that fall under the category of tax management (see our Insight entitled "Strategies to Manage Taxes in Retirement" for more), the development of an optimized retirement income strategy has the potential to yield the most significant benefit. In fact, the development of an optimal retirement income strategy lies just under the application of dynamic withdrawal rules in terms of the magnitude of potential value creation.

When and which type of account (i.e., taxable, tax-deferred, or Roth) you take money from to fund your retirement expenses can matter significantly because of the different tax rules that apply to each account type.

Retirement Income Planning Through the Lens of Conventional Wisdom

There is a retirement income strategy rule of thumb known as Conventional Wisdom. Conventional Wisdom states you should fund retirement expenses from taxable accounts first, then pre-tax retirement accounts, and then Roth accounts. The logic is that money from a taxable account is the best place to start because only the gain on the proceeds gets taxed at a lower capital gains rate (15% or 20%). Plus, this allows greater time for pre-tax retirement accounts to grow pre-tax.

After the taxable account is depleted, Conventional Wisdom states that your pre-tax retirement account is the next best, so you can allow your Roth account the longest time possible to grow tax-free.

Like most rules of thumb, Conventional Wisdom, while easy to understand and follow, is entirely overly simplified. In reality, the best retirement income strategy is the one that puts you in a position with the optimal mix of money in the various account types so that you can take a portion from each to stay under your highest marginal tax rate each year in retirement. Clearly, this involves a lot of inputs and math to determine.

Determining a Retirement Income Strategy

As retirement planning specialists, we believe that when it comes to retirement income strategies, the following factors should all be taken into consideration:

- your amount of annual spending (or withdrawal)

- your current and future potential mix of investment accounts (i.e., taxable, tax-deferred, and Roth)

- your current and future potential marginal tax rates

- your goals

- your asset allocation

- your potential Roth conversion strategies (to change your mix of investment accounts)

Given your inputs and assumptions, possible scenarios should be modeled to determine which retirement income strategy requires the lowest amount of remaining lifetime taxes.

As you can imagine, there are hundreds of different possible scenarios. This again is where working with a retirement specialist can have its benefits (see our Insight entitled "Retirement Specialist or Financial Advisor" for more). Through a system dedicated to this analysis, we can run and stack rank the possible scenarios. Just because a strategy ranks as best mathematically does not always mean it’s a good fit for the client, but it’s a great place to start the conversation.

A Real-World Example: Turning Strategy Into Savings Let’s look at a real-world example. Many of the physicians and high-net-worth individuals we work with share a similar profile: most of their wealth is held in taxable brokerage and pre-tax retirement accounts. Very little tends to be in Roth treated accounts because high-income earners are quickly phased out of being able to contribute, and Roth IRA conversions can be less beneficial during peak earnings years.

The example below illustrates how an optimized retirement income strategy can dramatically improve long-term tax efficiency for a couple in this situation, with an after-tax spending goal of $220,000 per year and total investment assets of $3.7 million.

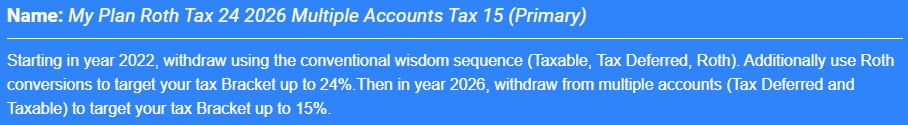

After entering all the required data, the following retirement income strategy is recommended as best, and it happens to fit well for this hypothetical couple:

In English, this retirement income strategy suggests the couple begin funding their retirement from taxable brokerage savings for the first four years while also completing Roth IRA conversions up to their 24% marginal tax bracket. Then starting in 2026, this couple should have a mix of investment accounts that will allow them to take a portion from all sources of savings such that they stay under the 15% marginal tax bracket for the remainder of their retirement.

Key Drivers of Value in This Retirement Income Strategy

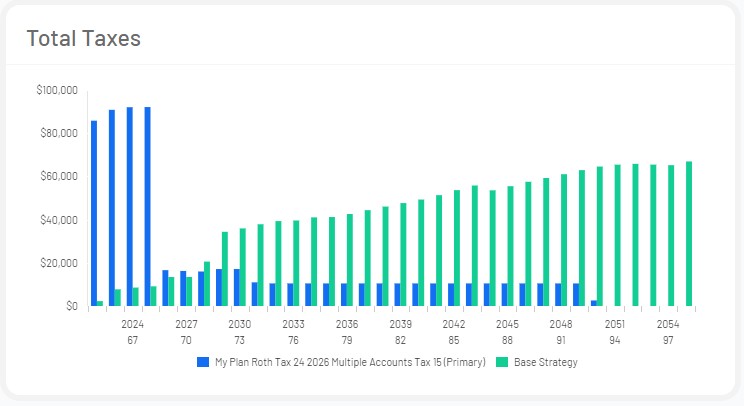

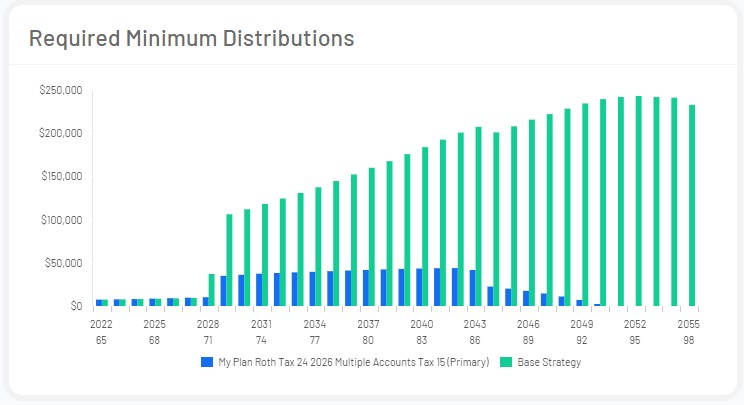

A couple of different factors are driving the value of this strategy. First, the suggested Roth IRA conversions are being done under current tax rates since there’s no telling when tax rates could go up in the future. (See our Insight entitled "What Drives Value in a Roth IRA Conversion Strategy" for more). Doing Roth IRA conversions now may substantially increase this couple’s taxes over the next four years, but will result in much lower tax bills beyond. This is because pre-tax retirement money (and the subsequent growth on that money) is moved into the Roth IRA, which greatly reduces the pre-tax account and the amount of future required minimum distributions (RMDs) that would eventually be taxed at even higher rates. You can see this in the illustrations below.

(Note that while these illustrations are as of 2022, the same concept of using a Roth IRA conversion to reduce your RMD still applies.)

How Much Value Exactly Does This Strategy Create?

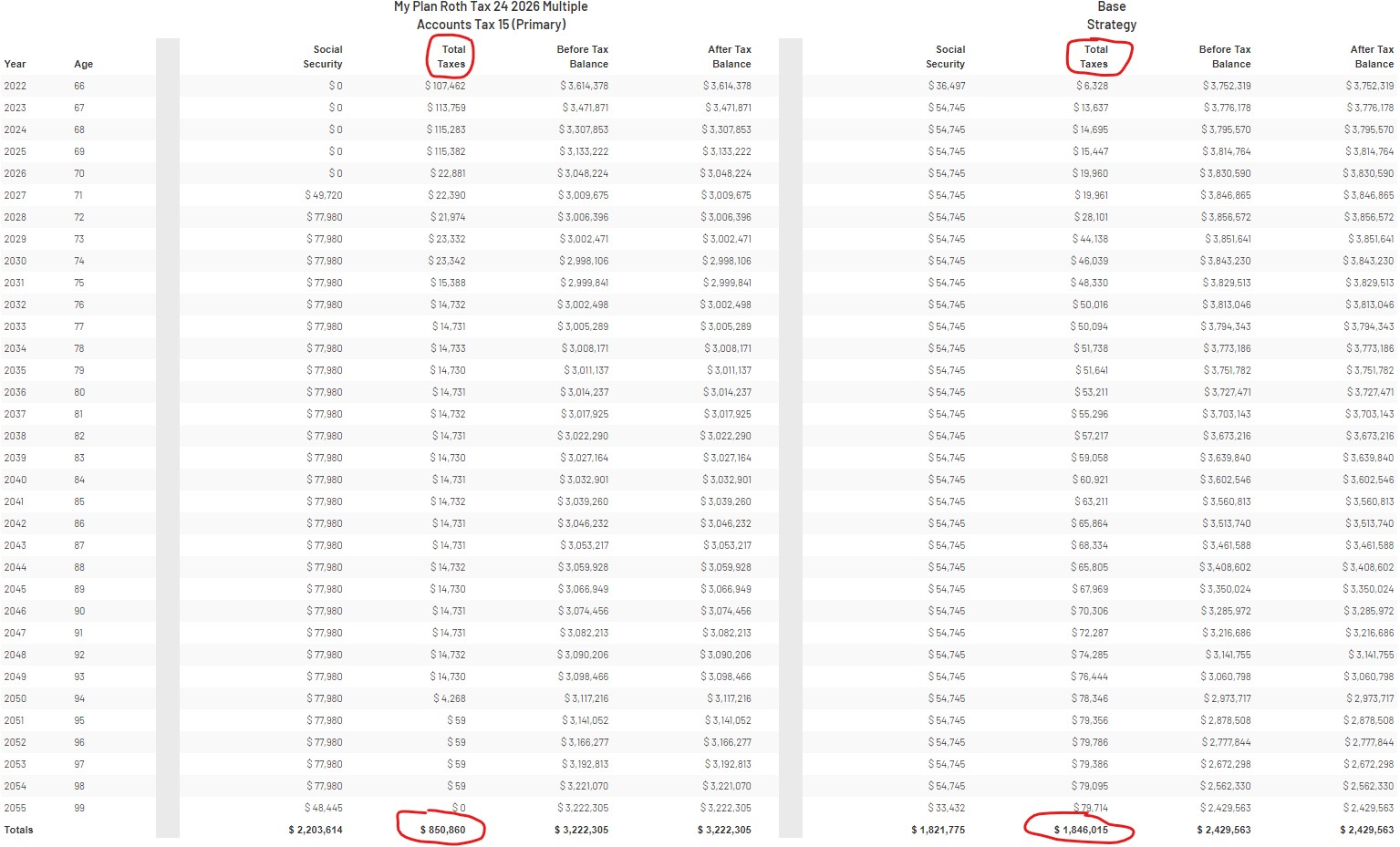

This retirement income strategy results in a total estimated remaining lifetime tax bill of $850,860 versus the “Base Strategy” (i.e., Conventional Wisdom) scenario’s total of $1,846,015 as can be seen in the schedule below (sorry it is so small):

This represents a very material tax savings of $995,155 over 33 years. Not bad!! Furthermore, any money left at passing will all be in a Roth IRA instead of a pre-tax IRA. This is significant as any retirement account money passed to a non-spouse beneficiary must be taken within ten years. If the money is in a Roth IRA account, the beneficiary can let it continue growing tax-free for ten years and then withdraw it all tax-free.

If the money is in a pre-tax IRA, the beneficiary is in a tax trap and will likely have to take a portion each year to avoid the bulk being taxed at the highest marginal tax rates. This can be especially problematic for beneficiaries in their peak earning years. Who knows where tax rates will be further into the future, but the highest marginal federal income tax rate will remain 37% in the near term thanks to the recent passage of the One Big Beautiful Bill. Between state and federal taxes, you can easily see a scenario where up to one-half of one’s legacy could be going to the government through taxes rather than to their intended beneficiary.

If you would like help in developing your optimal retirement income strategy, we stand by ready to help. Click here to get your complementary Thrive assessment and schedule an informal, introductory call with one of our retirement planning specialists to get started.