Donor Advised Fund Tax Benefits for Retirement Planning in 2025 and Beyond

KEY TAKEAWAYS:

- Donor Advised Funds (DAFs) offer triple tax advantages — immediate income tax deductions, avoidance of capital gains, and estate tax reduction — while allowing donors to control the timing and direction of their charitable gifts.

- DAFs can enhance retirement tax planning by enabling charitable bunching, reducing taxable income in high-earning years, and even creating opportunities to begin Roth conversions earlier.

- Donating appreciated assets to a DAF helps investors dispose of low-cost-basis holdings tax-efficiently, while integrating philanthropy with long-term wealth and retirement strategies.

For individuals who are currently charitably inclined or who aspire to be at some point, a Donor Advised Fund (DAF) can be a great tool to unlock several potential retirement and tax planning strategies.

As retirement specialists, we often incorporate DAFs into our clients’ retirement planning to help them make the most of their gifting. By combining charitable intent with smart tax and retirement planning, a DAF can help you maximize deductions, reduce taxable income, and align your wealth with the causes you care about most.

What is a Donor Advised Fund (DAF)?

A DAF is nothing more than a charitable investment account that you set up to provide simple, flexible, and efficient ways to manage charitable giving. A DAF account is set up through a non-profit sponsoring organization known as a DAF host.

Because the DAF host is a qualified charitable organization, the money or assets donated into a DAF becomes an irrevocable transfer to a public charity, and you immediately realize the tax benefits of the donation.

Donor Advised Fund Tax Benefits

When you make a donation to a DAF, you gain immediate tax advantages while keeping the flexibility to decide which charities will ultimately receive the funds at a later date. Here are some of the key donor advised fund tax benefits that you may be able to take advantage of:

- An immediate tax deduction on adjusted gross income (assuming itemized deductions exceed the standard deduction)

- The avoidance of capital gains on assets donated to the DAF

- A reduction of the gross estate by the amount of the excluded asset

In order to utilize these benefits, you’ll first have to start up by setting up a DAF through a DAF host.

Where Can You Find a Donor Advised Fund Host?

DAF hosts are qualified public charities that serve as the administrator of the DAF and help you direct grants to qualified charities and non-profit organizations on your timetable. The DAF host handles the accounting and reporting and assures compliance with IRS rules. A good DAF host will also help you develop and achieve your charitable goals by providing educational resources and research tools.

At Thrive Retirement Specialists, we often refer our clients seeking a DAF host to use Lively due to their combination of reputation, cost, ease of use, and relationship with -Charles Schwab (which allows us to manage the DAF investment account on our clients’ behalf – for no additional charge because of our flat fee!!). See our Insight entitled, "Why a Flat Fee Advisor is Best for Retirees" for more.

Now, let’s look at some specific strategies where you can use a DAF as a retirement and tax planning tool.

4 Smart Ways to Use a DAF as a Retirement and Tax Planning Tool

The tax benefits and giving flexibility of a DAF make it a great tool for retirement and tax planning. Following are four core strategies often used:

Charitable Bunching

Some individuals support specific charities or non-profit organizations with regular monthly, quarterly, or annual donations. A strategy known as charitable bunching through a DAF could yield significant tax savings for these individuals. Up until 2025, charitable deductions were only beneficial if, together with other itemized deductions, the amount donated exceeded the current standard deduction of $15,750 for single filers or $31,500 for married couples

However, the One Big Beautiful Bill Act (OBBBA) introduced several updates that impact how charitable deductions will work beginning in 2026:

- For non-itemizers: Taxpayers who take the standard deduction will now be allowed to deduct up to $1,000 (single filers) or $2,000 (married couples) in cash contributions to qualified charities each year.

- For itemizers: New limits apply. Deductions are now allowed only for amounts that exceed 0.5% of adjusted gross income (AGI), and the maximum marginal benefit of those deductions is capped at 35% for taxpayers in the highest income brackets.

For example, if a couple has an adjusted gross income (AGI) of $400,000, they can only deduct charitable contributions that exceed $2,000 (0.5% of AGI). So if they donate $10,000 in cash to a qualified charity, only $8,000 of that donation would be deductible. And if they’re in the highest tax bracket, the deduction would reduce their taxes at a maximum rate of 35%, rather than the full 37% that previously applied.

These updates expand access to charitable deductions for taxpayers who don’t itemize, but slightly reduce the tax benefit for high earners who do. If you are a high earner and want to take advantage of charitable bunching through using a DAF, now might be a great time to do so before the new rules apply in 2026.

Maximize Charitable Deduction Value in High Marginal Tax Rate Years

As retirement planning specialists, we often meet with many pre-retirees who are at their peak earnings in the years leading up to retirement. An individual with charitable intentions may choose to fund a DAF with the amounts they plan to give over their life during these peak earnings years to maximize the value of the charitable deductions given their high marginal income tax rates. As noted above, with the new OBBA rules taking effect in 2026, those in higher income brackets may see a reduced tax benefit from charitable deductions due to the new 0.5% AGI floor and 35% deduction cap, making 2025 an especially advantageous year to fund a DAF and secure the full value of today’s more favorable deduction limits.

The individual can then direct (or grant) the DAF funds to charities and non-profit organizations of their choice on their timetable later when they are under lower marginal tax rates in retirement. This strategy can be especially beneficial if an individual is still paying a mortgage and is near being able to itemize.

Lower Taxable Income in High Marginal Tax Rate Years

Roth IRA conversions tend to be less economically beneficial during peak earnings years. This requires many pre-retirees to wait until retiring to begin executing on beneficial Roth IRA conversion strategies. While many factors drive value in a Roth IRA conversion strategy, two of the most important are time and marginal tax rate differential (See our Insight entitled "What Drives Value in a Roth IRA Conversion Strategy" for more).

The longer your assets can grow inside a Roth IRA, compounding tax-free year after year, the greater their long-term benefit. Funding a DAF may help lower taxable income to a marginal tax rate level that favors starting a Roth IRA conversion strategy earlier.

Tax-Efficient Disposal of Low-Cost-Basis Assets You No Longer Wish to Hold

As one nears retirement, a prudent step to manage risk is to start transitioning one’s investment portfolio to a maximally diversified portfolio of low-cost index funds. There is less time to recover from mistakes now, so concentrated risk bets (i.e., individual stocks) should be avoided. See our Insight entitled "Building an Investment Portfolio for Retirement" for more. The problem may be that you have some really low-cost-basis assets in your account that you’ve held for years, and you do not want to sell and realize the capital gains. This is another problem the DAF is great at solving.

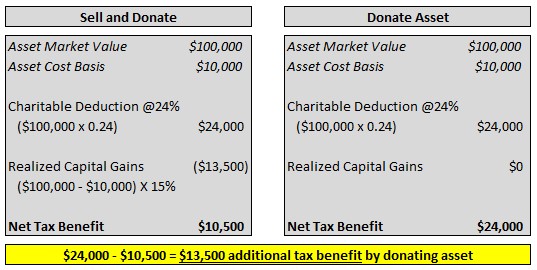

Donating a low-cost basis asset to a DAF yields a double-tax benefit. First, you get an income tax deduction equal to the asset's market value at the time of donation. Second, you get to remove the asset from your balance sheet without ever having to pay capital gains on the asset's appreciation. This could represent significant tax savings, as can be seen in the example below:

Make the Most of Donor Advised Fund Tax Benefits by Utilizing All Four Strategies

These four core strategies were isolated for the sake of explanation. When helping our clients with their retirement planning, we often find that many individuals tend to extract value from elements of all four of these strategies at once.

An overarching strategy should be developed that is coordinated with your overall retirement plan and that takes into consideration IRS limits to charitable deductions. While nothing in retirement and tax planning is easy, it is easy for those with charitable intent to see why DAFs are such a popular retirement and tax planning tool.

If you would like help establishing a donor advised fund as part of a retirement and tax plan, you can schedule a friendly, informal call with one of our retirement planning specialists here.