Know How Much is Enough to Retire with a Retirement Spending Plan

(READ TIME: ~6 MIN)

TAKEAWAYS:

- People often cling to widely known and well-disseminated "rules of thumb" to determine how much they need to save to be able to retire.

- Relying on "rules of thumb" designed for the masses increases the risk of spending too much time over-saving, potentially sacrificing higher quality of life (especially for higher-income individuals).

- Determining how much you will need to save starts with developing a custom Retirement Spending Plan and then comparing it to your Retirement Spending Capacity.

People work hard for many years to save for retirement, but how do you know when you’ve saved enough? At what point do you have the financial resources needed to make further work optional?

If you’ve tried to find the answer to the question of “how much money do I need to retire," you’ve probably come across many articles providing retirement rules of thumb. Unfortunately, in our decades of serving as retirement planning specialists, we’ve seen that many rules of thumb can lead people astray and adversely affect their retirement planning efforts.

When it comes to trying to figure out their retirement spending capacity, many cling to the widely known and well-disseminated rule of thumb, Multiple of Salary, without knowledge of a better methodology.

Here, we address the pitfalls and dangers of relying on the Multiple of Salary for Retirement rule of thumb and help you understand what factors to ensure you consider as part of your retirement planning so you can craft a realistic retirement spending plan.

Multiple of Salary Rule of Thumb for Retirement

The Multiple of Salary rule of thumb states that a person should have so many times their annual salary saved in an investment portfolio to have enough financial resources to maintain their existing lifestyle in retirement.

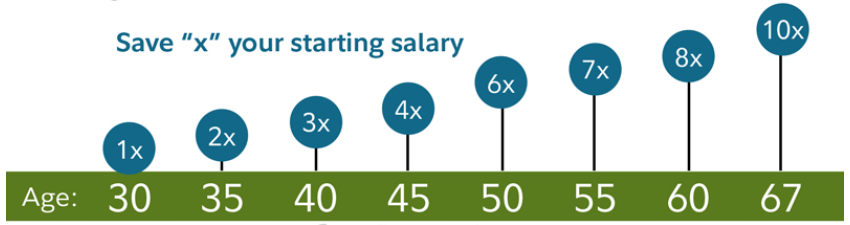

Fidelity, for example, has this Multiple of Salary Rule chart listed on their website:

Fidelity’s guideline is that you should save 10x your salary by age 67. According to Fidelity, if you can stay on track with these “age-based retirement savings factors,” you should be able to maintain your pre-retirement lifestyle in retirement. Fidelity’s assumptions are that a person saves 15% of their income annually beginning at age 25 (which includes any employer match), invests more than 50% on average of their savings in stocks over their lifetime, retires at age 67, and plans to maintain their pre-retirement lifestyle in retirement.

Seriously!? While we can appreciate the effort of trying to provide people with some guidance, trying to simplify something that is not this simple can cause more harm than good.

Here are 5 reasons we believe the Multiple of Salary rule of thumb can be problematic when trying to figure out your retirement spending plan:

Your Pre-Retirement Income May Not Be The Target

You may find that you need more or less than your pre-retirement income to be able to fund your ideal retirement lifestyle. Pre-retirement income is the wrong number. The right number is the one that allows you to live the way you want to in retirement. For some people, that means more; for others, it means less.

Misleading Targets for Different Incomes

The Multiple of Salary rule can provide false confidence for lower-income individuals while overestimating what higher-income individuals need. For example, a high-earning professional might end up with a target portfolio that seems excessive when taking into account the actual amount needed to live well in retirement.

Social Security Replacement Rates

Based on data collected from J.P. Morgan Asset Management, Social Security replaces ~72% of a $30k pre-retirement income. In contrast, it only replaces ~12% of a $300k pre-retirement income. The lower the Social Security replacement rate, the greater the withdrawal as a percent of the portfolio that would be needed.

Retirement Spending is Not Linear

Research shows that retirement spending tends to follow a curve shaped more similarly to a smile than a straight line. Retirees tend to spend the most in early retirement (the “go-go” years) when they are relatively healthy and able to do so. Eventually, health and/or other factors lead to a decline in overall spending (the “slow-go” years) before they spike again in the final years as higher health-related costs like assisted living may enter the equation (the “no-go” years). Assuming that spending is linear will tend to overstate how much may really be needed.

Spending Flexibility Matters

A retiree who is not willing or able to decrease spending if investment markets correct (or decline substantially) will have to start with a much lower distribution rate than a retiree who is willing and able to reduce spending (often only temporarily) as required by adverse market conditions.

Ignoring After-Tax Income

Last, but not definitely not least, the rule does not consider your after-tax income or the type of account your retirement savings are held in. This can result in significant discrepancies when planning for retirement income. Let’s look at this one in more detail.

What About the Impact of Tax?

The Multiple of Salary rule of thumb ignores the fact that people don’t live on gross salary, but rather on after-tax, or take home, income. The Multiple of Salary approach does not consider where your savings are located (pre-tax, after-tax, or Roth) or how they will be taxed in the future. As you can imagine, this can cause enormous distortions, especially for higher-income individuals.

For example, if a 67 year old single attorney in California is making $1,000,000, Fidelity’s guidance would suggest a $10,000,000 portfolio is needed. The reality is that the attorney would only be taking home $566,780 per year after paying $433,220 in federal and state taxes (a 43% effective tax rate) and probably does not even need that much every year to live out a rewarding retirement.

Further, whatever amount is needed will not all be funded from pre-tax retirement accounts (as higher net-worth individuals usually have substantial after-tax brokerage account savings as well).

Let's say we determine $400,000 after taxes is needed per year, and half is being funded from a pre-tax retirement account, and the other half is being funded from an after-tax brokerage account with 50% long-term capital gains. Taking a $250,000 pre-tax distribution plus paying capital gains tax on $125,000 of the $250,000 after-tax brokerage withdrawal would yield close to the $400,000 needed after paying $107,427 of federal and state tax (a 21% effective tax rate).

As a result of the attorney needing less than his $566,780 take-home pay (only $400,000) and the effective tax rate being cut in half, only $500,000 from the aggregate portfolio is needed.

Following Fidelity’s guidance, this would suggest that a $5,000,000 ($500,000 x 10) portfolio would be needed, a far cry from the $10,000,000 believed initially. This tax issue is just the tip of the iceberg. This is why it’s so important to consult a retirement planning specialist or a financial advisor before choosing a retirement spending amount as your target when saving for retirement.

So What Should You Do Instead? Determine What You Need with a Retirement Spending Plan

At the end of the day, the Multiple of Salary approach is basically meaningless to any one individual. Any mass-made approach will be useless. You must take a personalized approach that allows you to define your ideal retirement lifestyle and that considers your situation and resources.

The good news is there’s an alternative way to determine how much is enough. It begins with defining your ideal retirement lifestyle and thinking through how it might change over time.

As a baseline, start with what you spend today to maintain your current lifestyle. You can then begin to make changes based on the changes you want/expect to see as you progress through retirement.

The tool we use with clients to facilitate this exercise is known as a Retirement Spending Plan. Your retirement spending plan is an estimate of how you will spend money in retirement to support your goals and ideal retirement vision. This plan will allow you to evaluate tradeoffs now and as you progress through retirement.

The intent is not to be held accountable for spending exactly as your plan dictates at a detailed level; rather, it is to make sure you consider everything to ensure you have enough retirement assets and a strategy to meet bottom-line spending needs.

Your Retirement Spending Plan vs Your Retirement Spending Capacity

Armed with a custom Retirement Spending Plan, you can then bump that up against your Retirement Spending Capacity. Your Retirement Spending Capacity is the sustainable spending your financial resources and unique circumstances can afford.

If your Retirement Spending Capacity exceeds your Retirement Spending Plan, congratulations, you can now make further work optional. If not, you can look to make tradeoffs in your Retirement Spending Plan or figure out what is needed (i.e., more time, more savings, more willingness to be flexible in your spending, etc.) to close the gap. While more complicated than simply multiplying a pre-retirement salary, you will significantly reduce the risk of spending time over-saving and potentially sacrificing quality of life.

If you want help determining your Retirement Spending Plan and figuring out your Retirement Spending Capacity, contact our retirement planning specialists to help. Click here to get a complimentary Thrive Assessment and schedule an informal, introductory Zoom call to get started.