Income Planning for Retirement: How Risk-Based Guardrails Outshine Withdrawal-Rate Guardrails

(READ TIME: ~5 MIN)

TAKEAWAYS:

- Most dynamic withdrawal strategies are based on withdrawal-rate retirement guardrails, but relying on withdrawal rates causes issues in practice.

- Using risk-based retirement guardrails that instead rely on total risk can avoid the issues with withdrawal-rate guardrails.

- A dynamic (or flexible) approach to retirement withdrawals can allow a retiree to start off with 30% more income based on Morningstar research.

When planning for retirement income, one of the most critical decisions is determining how to withdraw funds from a retirement portfolio.

A traditional, static approach often relies on predetermined withdrawal rates, such as the popular 4% rule, which suggests that retirees can safely withdraw 4% of their portfolio annually.

However, this method can sometimes fall short of meeting a retiree's needs over time, especially during periods of market volatility or if the retiree’s spending needs change.

Here, we discuss some more dynamic methods to retirement portfolio withdrawals, including the withdrawal-rate guardrails and the risk-based guardrails retirement strategy to help you understand how each could impact your retirement income planning.

A More Dynamic Approach to Retirement Portfolio Withdrawals

Research has shown us that taking a dynamic (or flexible) approach to portfolio withdrawals allows retirees to start with higher safe withdrawal rates and spend (or gift) more from their retirement portfolios throughout their retirement. (See our Insight entitled “The Tradeoffs of 3 Popular Withdrawal Strategies” for more).

In their “The State of Retirement Income: 2023” research paper, Morningstar researchers found that dynamic withdrawal strategies offered the highest starting safe withdrawal rate, allowing 30% more retirement income than with a conventional and predominately used total return with rebalancing withdrawal strategy.

In their “Alpha, Beta, and Now… Gamma” research paper, Morningstar even goes so far as to say dynamic withdrawal strategies can create more value than all of the tax-management strategies combined (fortunately, these things aren’t mutually exclusive because we believe in both strongly and apply both in practice).

There is no question about the value dynamic withdrawal strategies can provide, but how to implement them in practice is less clear. So let’s take a look at how each of these works, starting with withdrawal-rate guardrails.

Retirement Income Planning with Withdrawal-Rate Guardrails

The most popular and well known of the withdrawal-rate guardrail strategies is the Guyton-Klinger Rule, tested by Jonathan Guyton and William Klinger in a 2006 Journal of Financial Planning paper. The Guyton guardrails strategy is based on a set of "guardrails" or boundaries to guide how much the retiree can safely withdraw each year without jeopardizing the long-term sustainability of their retirement funds.

The Guyton guardrails are predetermined upper and lower limits for withdrawal adjustments. The idea is to prevent drastic fluctuations in withdrawals, which could either deprive the retiree of necessary income or deplete the portfolio too quickly.

An example of a withdrawal-rate guardrail rule could look as follows (based on a $3 million portfolio):

- Withdrawal Rule: Begin with a 5% withdrawal rate (5% x $3.0M = $150k)

- Prosperity Rule (upper guardrail): Increase income by some amount if the withdrawal rate falls below 3% ($150k/3% means a portfolio value increased to $5.0M)

- Preservation Rule (lower guardrail): Decrease income by some amount if the withdrawal rate rises to 6% ($150k/6% means portfolio value decreased to $2.5M)

The Problem with Withdrawal-Rate Guardrails

The problem with withdrawal-rate guardrails is that they are challenging to implement in practice because they rely on steady retirement portfolio withdrawal rates that tend not to occur in reality. Withdrawal rates from a retiree’s portfolio can often be lumpy (especially in earlier retirement) depending on a retiree’s sources and needs of income.

An example of this could be a retiree who needs to withdraw more from his portfolio for the next several years because he is waiting until age 70 to claim Social Security. Another example could be a retiree who needs more from his portfolio today to cover the higher tax liability from a Roth IRA conversion strategy. Less would be needed in future years as tax liabilities fall.

Another problem with withdrawal-rate guardrails is that they cannot handle the reality that research shows retirement expenses tend to go down over retirement (J.P. Morgan Asset Management, David Blanchett, and more).

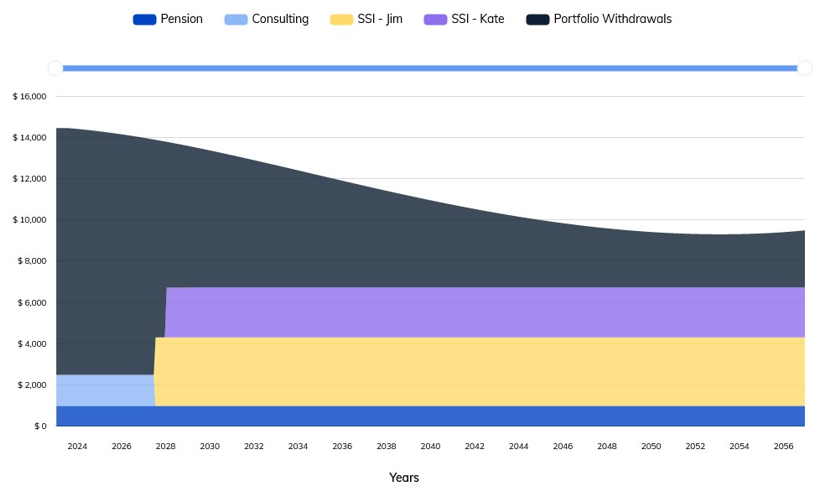

Following is what a real-world inflation-adjusted cash flow chart in retirement could look like:

Over time, you can see from the dark “Portfolio Withdrawals” area that portfolio withdrawals are not necessarily steady enough to practically use a withdrawal-rate set of guardrail rules.

Retirement Income Planning with Risk-Based Guardrails

As retirement planning specialists that have helped hundreds of clients create a sustainable retirement income strategy, we believe risk-based guardrails are a better choice of the two dynamic approaches to retirement income planning.

Risk-based guardrails solve for the shortfalls posed by withdrawal-rate guardrails because they rely on total risk as their measure. There are really no limitations to what risk-based guardrails can handle because all factors that can affect a retirement plan are considered in its measurement.

An example of a risk-based guardrail rule could look as follows:

- Withdrawal Rule: Begin by spending an amount that leaves your plan with an 80% probability of success (or level of risk).

- Prosperity Rule (upper guardrail): If the probability of success rises to ~99%, increase spending to a level associated with 20 points higher risk (restoring the plan’s risk level to its original 80% probability of success)

- Preservation Rule (lower guardrail): If the probability of success falls to 60%, decrease spending to a level associated with 20 points lower risk (80% probability of success).

Risk-based guardrails can give retirees a more accurate picture of how much they can sustainably spend. While risk-based retirement guardrails are considerably more complex to calculate because of the many factors considered in the risk-based model, technology enables risk-based guardrails to be implemented and maintained efficiently and effectively.

A More Realistic Approach to Income Planning for Retirement

The dynamic calculation and real-time incorporation of reality add to the qualities that make risk-based guardrails a great tool for ongoing retirement planning guidance and monitoring for changes needed or allowed in spending.

If you want to take a dynamic approach to your portfolio withdrawals and need help setting up and maintaining your risk-based guardrails, we are here to help. You can click here to schedule an informal, introductory Zoom call to chat with a retirement planning specialist who will help you find the right approach based on your goals.