Leave a Legacy of Learning: Smart College Planning for Grandparents

Key Takeaways:

- Helping to pay for a grandchild’s college lets grandparents leave a legacy during their lifetime, likely when it’s most impactful, instead of through an inheritance.

- Balance tax benefits and flexibility when choosing how to fund college expenses by using a 529 plan, taxable brokerage account, or a combination of both to allow adaptable funding options.

- Prevent and manage overfunded 529 accounts by determining a reasonable savings target, coordinating savings with your family, and using options like Roth IRA rollovers or beneficiary changes to avoid penalties.

As retirement planning specialists, we work with many clients who prioritize not only having a sustainable income in retirement, but also leaving a legacy to those they care about, including their children and grandchildren.

Helping a grandchild pay for college is more than a thoughtful gift – it’s a way for grandparents to express their values by prioritizing education and using money to make the lives of their loved ones easier during their lifetime, often when it’s most impactful. However, with high and unpredictable costs, as well as trade-offs associated with the different funding options, creating a college funding plan can become complicated quickly – but it doesn’t have to.

By following these three simple steps, you can develop a flexible and tax-efficient strategy that helps open the door for your grandchild today, rather than after you’re gone.

1). Estimate College Costs

To avoid the risk of significantly under-saving or over-saving, we must first estimate costs. The current age of your grandchild will help you determine the best approach to take, as the older they are, the more clarity you should have regarding the type of school they’ll attend.

For example, using national averages for tuition and fees is likely the best approach when saving for a three-year-old, whereas using specific college cost information (College Navigator is a good resource) is more appropriate for a high school junior who has a short list of schools.

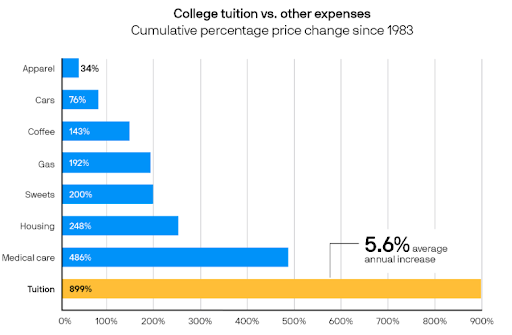

The cost of a college education can be daunting, with national averages ranging from approximately $25,000 to $59,000 for one year of undergraduate expenses (tuition, fees, and room and board) at a public in-state college and a private college, respectively. On top of that, college tuition has historically inflated at a higher rate than other expenses.

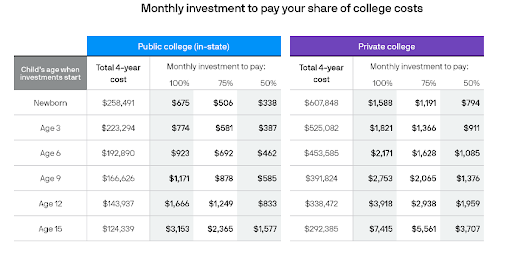

For a child currently three years old, the cost of an undergraduate degree would grow to about $223,000 at a public school and more than (a staggering) $500,000 at a private school! As shown in the table below, fully funding four years at a public school can be achieved with $774 per month in savings, or a lump sum investment of ~$90,000, if we perform a separate present value calculation. Funding four years of private school requires saving more than double those amounts.

2.) Decide Whether to Use a 529 Plan or a Taxable Brokerage Account

Once you know how much you need to save for your grandchild’s college, you need to decide which kind of account to save into. While you could just put the money aside into a taxable brokerage account, doing that could mean losing out on the tax benefits associated with a 529 college savings plan.

529 Plans Tax Benefits

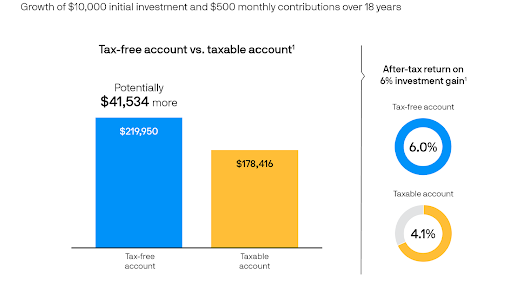

The benefit of 529 accounts is that they provide tax-free growth and withdrawals, if those withdrawals are used for qualified education expenses. The more years your grandchild has until college, the more you benefit from the tax-free growth of a 529 account.

The benefits of tax-free growth and withdrawals can’t be emphasized enough, as they significantly boost college savings, as seen in the following illustration.

If tax-free savings aren’t enticing enough, here are some other benefits of 529s:

- State Tax Deduction: Some states allow tax deductions for contributions (up to a limit). This could make contributions worthwhile regardless of your grandchild’s age (even if they’re currently in college).

- Control: You always retain control over the account. This isn’t the case if you used other account types, like custodial accounts (UGMA/UTMA) or Coverdell ESAs.

- They Don’t Impact Financial Aid Eligibility: Starting in the 2024-2025 school year, distributions from grandparent-owned 529s no longer impact a student’s eligibility for needs-based financial aid. This is not the case for parent-owned 529s.

- Front-Load Contributions to Maximize Growth and Reduce Estate Size: If you’re concerned about estate taxes or you simply want to be able to stock away a larger chunk of money into a 529 in one year to maximize the growth of the account thanks to the power of compound interest, you can also take advantage of what’s known as “superfunding.” This is, an option to lump five years’ worth of your annual gift tax exclusion into one contribution. This means married couples can contribute up to $190,000 ($95,000 for singles) in 2025, which removes the funds from their estate without reducing their lifetime gift and estate exemption, and maximizes the time the funds are invested, potentially achieving more tax-free growth.

Some people shy away from 529s because they prefer the flexibility to use funds for non-college expenses without incurring penalties, such as a home down payment or when their grandchild does not attend college. If that describes you, the easiest route is to plan on paying tuition directly to the college using funds outside of a 529. While you wouldn’t receive the tax-free growth offered by 529s, you maintain maximum flexibility, and the IRS exempts the tuition payments from counting towards your gift tax exclusion.

However, if you are set on using funds outside of a 529 plan, a more effective approach may be to utilize both 529 and non-529 savings, such as a taxable brokerage account, to cover college costs. This compromise enables you to strike a balance between tax-free growth and flexibility, so that you have money diversified across several buckets, allowing you to then use whichever bucket meets your needs at the time. Typically, it is best to tap into the 529 plan last to maximize tax-free growth if you take this approach.

If you plan to use funds outside of a 529, you may want to open a brokerage account that’s earmarked for your grandchild’s college expenses. That way, you can invest according to their planned enrollment date -- likely different than how your retirement accounts should be invested -- and better track contributions and withdrawals, which is handy if you’re saving for multiple grandchildren and want to keep their accounts equal.

3). Invest the Funds Based on Your Grandchild’s College Timeline

When investing 529 plan funds, it’s important to align your investment strategy with your grandchild’s college timeline. If the child is still young, you can take advantage of a more aggressive approach—allocating a larger portion of the funds to stocks or equity-based funds to maximize growth potential over time.

As the child gets closer to college, typically within five to seven years of enrollment, you may consider gradually shifting toward more conservative investments like bonds or money market funds to protect the balance from market volatility. Many 529 plans also offer age-based or target enrollment portfolios that automatically adjust the asset mix as the beneficiary approaches college age, making it easier to match risk with the time horizon.

Bonus Insight: How to Handle Overfunded 529s

Overfunding a 529 plan often happens when families overestimate future education costs or fail to coordinate contributions. For instance, parents or grandparents may contribute aggressively, expecting steep tuition bills, only for the student to earn scholarships or attend a more affordable school. In some cases, multiple 529 plans are opened by different family members without a clear strategy, leading to combined contributions that exceed the actual need.

While overfunding a 529 may seem like a good problem, keep in mind that the IRS assesses a 10% penalty plus income tax on the earnings portion of withdrawals not used for qualified education expenses.

What Counts as 529 Plan Eligible Expenses?

Qualified education expenses include tuition and fees at eligible colleges, universities, and trade schools, as well as room and board for students enrolled at least half-time. Other covered costs include books, supplies, computers, and necessary software or internet access.

To avoid overfunding a 529 plan, it’s crucial to do two things: (1) follow the steps above to get a reasonable estimate on how much you should save, and (2) coordinate with your children regarding any amount they’re saving to a 529 (they’ll be grateful you did) as it’s not uncommon for families to have multiple 529s for the same child.

If you do end up overfunding a 529, however, you may able to lean on recent tax law changes that have made 529 plans more flexible by expanding distribution options. Some of these are outlined below:

- Roth IRA Rollover: You can rollover up to $35,000 from a 529 plan to a Roth IRA for your grandchild. This is a lifetime maximum, and the annual rollover amounts are limited to Roth IRA contribution limits ($7,000 in 2025). The 529 must have been opened at least 15 years before the rollover, which is another reason to start saving in a 529 early.

- Change the Beneficiary: You’re allowed to transfer the 529 balance to one or multiple beneficiaries, such as to your other grandchildren.

- Fund K-12 Tuition: Up to $10,000 per year. This could be useful if the account has grown more than expected and you project it to be overfunded by the time your grandchild enrolls in college.

- Non-Qualified Distributions: While paying income tax plus a 10% penalty on earnings isn’t ideal, it’s a viable option if the other options don’t fit your intended use for the funds, such as for non-retirement purposes. And if your grandchild is in a low tax bracket (the distributions flow to their tax return), it may not be such a bad deal.

Saving for your grandchild’s college doesn’t need to be complicated. By estimating costs and understanding the pros and cons of your funding options, you can create a plan that supports your goals and serves as a meaningful legacy for your grandchild.

If you’d like help estimating college costs for your children or grandchildren or understanding how contributing to their college costs may affect your retirement plan, click here to schedule a complementary call with our retirement planning specialists today.