Why A Target Asset Allocation is Key to Successful Investing

KEY TAKEAWAYS

- A target asset allocation gives you a clear roadmap for balancing growth potential with risk.

- It keeps your portfolio diversified, disciplined, and less vulnerable to emotional mistakes.

- Having a plan for your target asset allocation helps you know how to invest new money or rebalance your portfolio strategically.

If you’re like most people, you probably started your investing career shortly after you began working by selecting a couple of investment options in your 401k/403b to invest your pre-tax retirement plan savings. As you earned more, and began to max out your 401k/403b savings, you started directing extra savings to an after-tax brokerage account. You may have purchased more active funds, index funds, and/or individual stocks, such as Apple or Nvidia.

By the time you reach the mid-to-late stage of your career, you’ve managed to accumulate a substantial amount of money; however, this wealth now causes you to start worrying about loss, especially as you begin thinking about retirement someday. You start to wonder if you should take some risk off the table. However, you also worry about ensuring that your return potential keeps you on track to meet your retirement goals.

As retirement planning specialists, we understand what it feels like to worry about your portfolio dropping in value or to wonder if you’re at risk of a large loss if a certain asset or asset class underperforms. That’s why we act as a guide to help clients ensure their investments are aligned with their retirement income goals and other goals. One of the main tools we use to do this is target asset allocation. Here, we explain what a target asset allocation is and how you can apply it to your portfolio.

What is a Target Asset Allocation?

Your target asset allocation is the ideal portfolio structure for achieving your financial goals within your risk tolerance and relevant investment time horizon. Determining your target asset allocation is an exercise in portfolio construction.

First, you must determine which asset classes (stocks, real estate, bonds, etc.) should be a part of your well-diversified target asset allocation. Second, you have to determine which percentage of your portfolio should go to each asset class so that you are maximizing your return potential at each level of risk you are willing and able to take. This also includes determining which percentage of your portfolio should go to each sub-asset class such as domestic vs international stocks.

You then have to “right-size” your risk so you do not end up taking on more risk than you realize or can tolerate, which can lead to detrimental, emotionally charged moves at the wrong time. To determine a proper asset allocation for retirement, you need to assess and reconcile your need to take risk, ability to take risk, and willingness to take risk. This reconciliation will determine how much of your target asset allocation should be allocated to stocks versus bonds. Let’s take a look at what this could look like with an example.

An Example of Using A Target Asset Allocation

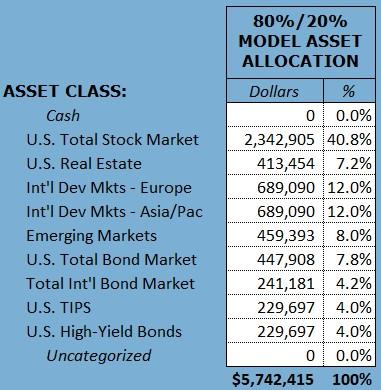

Let’s pretend that Jack and Diane have determined the following 80% stock and 20% bond target asset allocation is correct for their investment portfolio given their retirement planning goals and income needs:

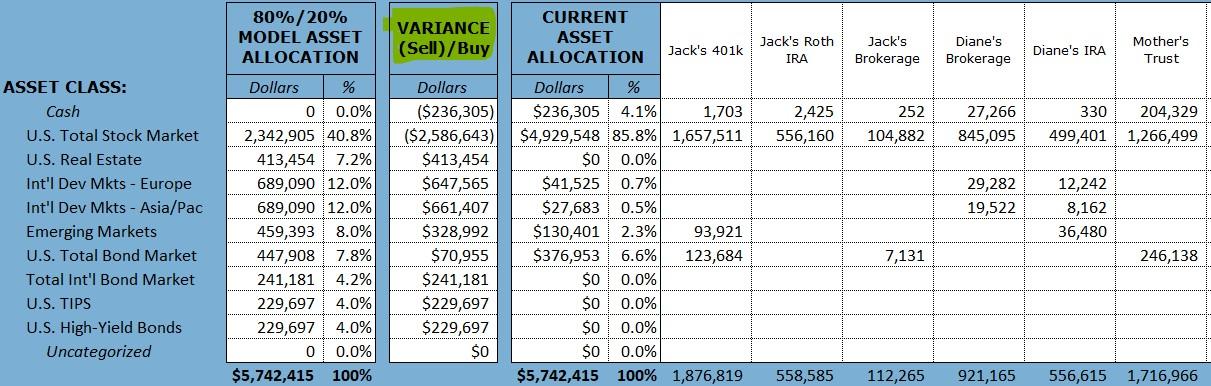

Their next step is to assess their current asset class exposures across their financial accounts:

Now Jack and Diane can see where they have too much asset class concentration (i.e., risk) and should sell, and where they have an opportunity to improve diversification by increasing asset class exposure.

In this example, looking under the “VARIANCE” column, Jack and Diane see they should seek to reduce their U.S. Total Stock Market exposure by ~$2,600,000 and reinvest this sum across the remaining asset classes by the amount shown to help them diversify their stock exposure.

Word of Caution: Taxes and Asset Location Matter When Making Allocation Changes

Transitioning a portfolio can be tricky business and must be done with care. You’ll want to be careful that you do not end up taking capital gains unnecessarily or unintentionally in taxable accounts. You’ll also want to be cognizant of where (i.e., which account type – pre-tax, after-tax, or Roth) you’re holding specific asset class exposures, given the unique characteristics of each asset class and different taxation under each account type.

For instance, you would not want to hold a REIT index fund in a taxable account because the high annual income distribution would be taxable as ordinary income each year. Holding a REIT index fund in a pre-tax account would make more sense since its annual income distribution would be tax deferred.

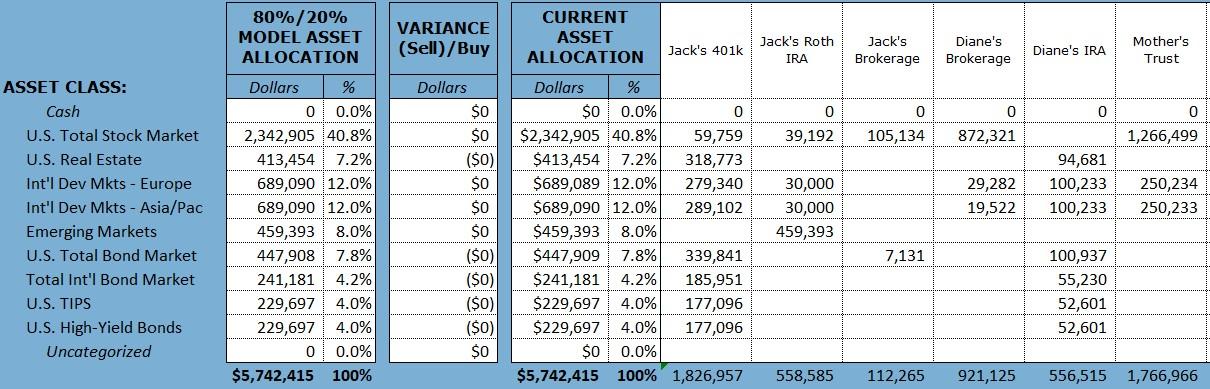

Fortunately, in our example, Jack’s 401k had some great investment options that we could leverage, and we were able to make the U.S. Stock Market sales needed in their 401k and IRAs, so we did not have to incur any capital gains in their taxable accounts. We further invested as follows:

The Benefits of Having a Target Asset Allocation to Follow

Once you go through the above process, your target asset allocation will provide structure, discipline, and a framework for making investment decisions. With it, you are now less vulnerable to risk, emotional mistakes, and falling short of your financial objectives.

Your target asset allocation will help you maintain your portfolio’s intended risk-return characteristics that you determined were right for you by showing you when it is time to rebalance the portfolio. Over time, market movements will cause the actual allocation to drift from the target. Periodic rebalancing brings the portfolio back in line with the target allocation.

The disciplined framework for making investment decisions will help you make unemotional trades that can be hard to make. Rebalancing involves selling assets that have appreciated in the portfolio and buying those that have declined or performed less well. Following a contrarian sell-high and buy-low discipline can be very hard to execute absent this framework.

You’ll always know where to invest new funds as well as what funds to sell if a distribution is needed. No more emotional agonizing.

If you need help constructing and transitioning to a target asset allocation that’s right for you, click here to schedule a call with one of our retirement planning specialists and get a complimentary Thrive assessment.