8 Key One Big Beautiful Bill Tax Changes That Can Affect Your Retirement Planning

Key Takeaways:

- Key tax provisions made permanent or expanded: The OBBBA locks in TCJA’s lower tax rates, raises the standard deduction, introduces a temporary $6,000 age 65+ deduction, increases the SALT cap to $40,000 (through 2029), and makes permanent an even higher estate and gift tax exemption of $15M per person.

- New rules create opportunities and pitfalls: From the 35% cap on itemized deductions and new charitable deduction limits to the repeal of clean energy credits after 2025, timing decisions around deductions, donations, and large purchases are more important than ever.

- Act now to benefit most: Reviewing withholdings, tracking itemized deductions, updating Roth conversion strategies, accelerating deductions, and acting quickly on EV and home energy credits can help retirees capture meaningful tax savings.

With the passage of the One Big Beautiful Bill Act (OBBBA), we finally have clarity on tax law that shapes retirement planning strategies. While many are subtle adjustments to the Tax Cuts and Jobs Act (TCJA), new deductions, phase-out thresholds, and rule changes add fresh layers of complexity.

As retirement planning specialists, we believe that you can’t have a good retirement plan without a solid tax plan. That’s why we’re always on the lookout for tax changes that could affect the financial well-being of retirees. So here, we summarize the key provisions of the One Big Beautiful Bill Act along with planning opportunities we believe will matter most to many retirees.

1). Permanent Extension Of Lower Tax Rates And Brackets

Arguably, the biggest question on many people’s minds was whether individual tax rates would revert to the (higher) pre-TCJA rates. After all, tax rates not only impact retirement income over the near-term, but also affect the long-term tax-savings benefits of many tax planning strategies, like Roth conversions.

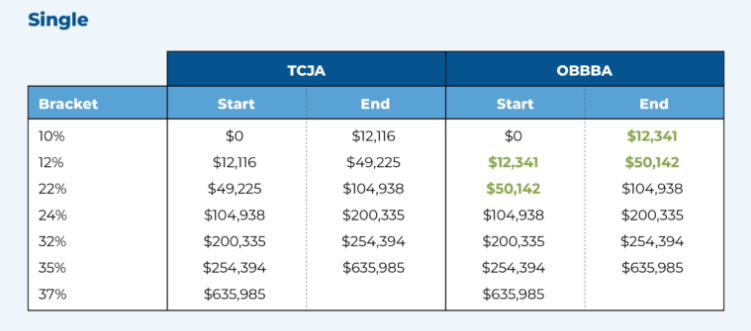

OBBBA makes the tax rates enacted in the TCJA permanent, with extra inflation adjustments for the 10% and 12% tax brackets (highlighted in green in the tables below).

Estimated 2026 Tax Brackets

2). Increased Standard Deduction and an Additional age 65+ deduction

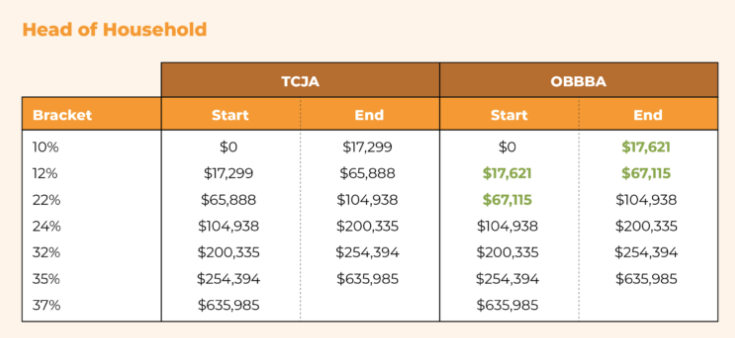

The standard deduction will get a small increase compared to the TCJA amount starting in 2025. And of particular interest to retirees is the $6,000 deduction temporarily available for taxpayers ages 65+ for the 2025-2028 tax years. This deduction is in addition to the existing $2,000 ($1,600 each for joint filers) deduction for seniors. However, it's worth noting that it completely phases out with a modified adjusted gross income of $175,000 (single) and $250,000 (married filing jointly).

Deductions for Taxpayers Ages 65+

3). State and Local Tax (SALT) Deduction Increased

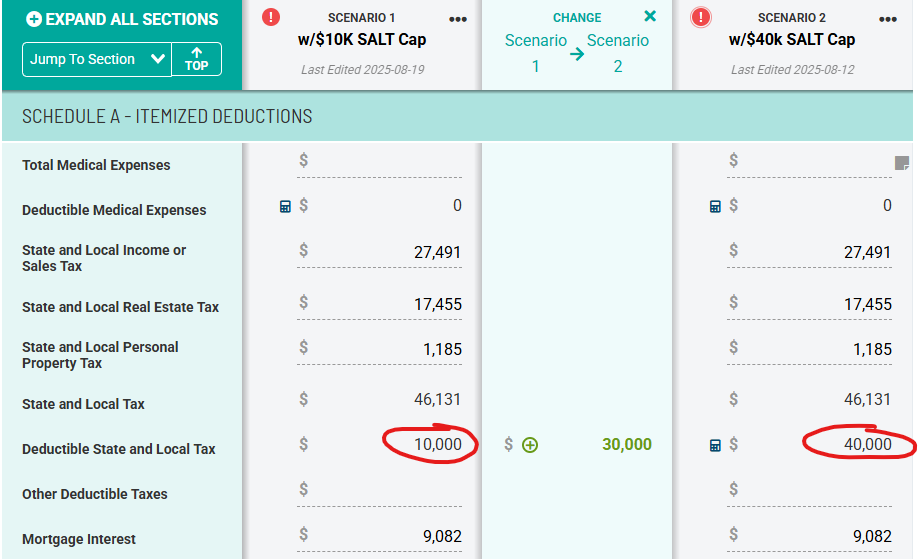

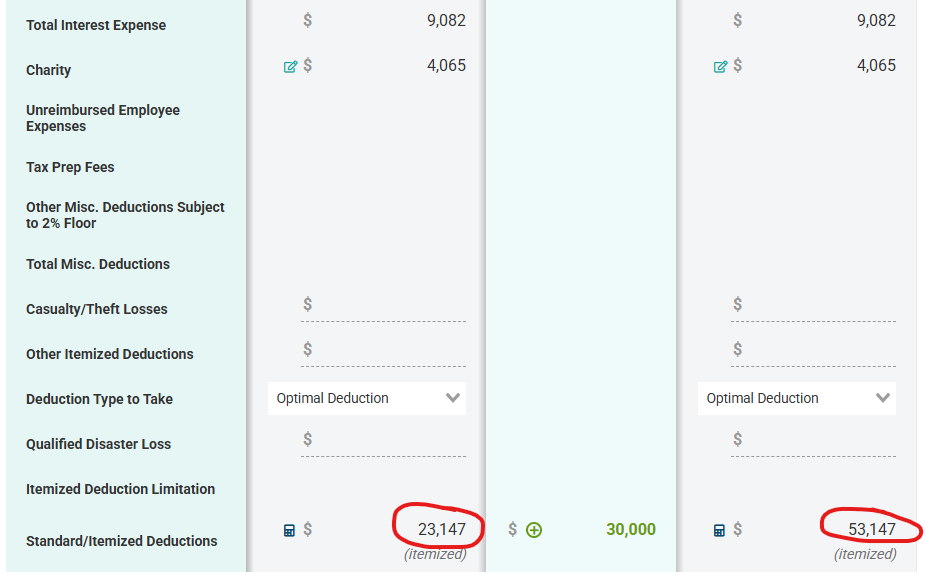

Much to the relief of retirees who live in higher tax states like those on the east and west coasts, the $10,000 state and local tax (SALT) deduction cap is temporarily increased to $40,000 starting in 2025.

This change alone could lead to many retirees switching from the standard deduction to the itemized deduction, or, if they already itemize, possibly receiving a hefty increase to their deduction. As seen in the example below, the higher SALT cap increased this taxpayer's itemized deduction by $30,000 – a ~130% increase!

Keep in mind that the SALT cap increase is temporary, reverting to $10,000 in 2030. And it begins to phase out for taxpayers with modified adjusted gross income (MAGI) over $500,000.

4). New Cap on Itemized Deductions

Starting in 2026, itemized deductions are only worth $0.35 on the dollar, which reduces their value by 2% for taxpayers in the top 37% tax bracket (taxable income of ~$635,000 and ~$736,000 for single and married filing jointly). In other words, for every $1.00 of itemized deductions, only $0.35 will reduce taxable income.

While a 2% reduction isn’t changing any outcome for a high-income household, it’s worthwhile for retirees in the 37% tax bracket to consider accelerating itemized deductions, like charitable contributions, in 2025 instead of waiting.

5). Charitable Contributions Without Having to Itemize

If you take the standard deduction, a deduction is added for charitable contributions, starting in 2026 ($1,000 for single filers, $2,000 for joint filers). Previously, charitable contributions could only be deducted if you itemized deductions.

If you itemize deductions, there’s a 0.5% Adjusted Gross Income (AGI) floor for charitable contributions that starts in 2026 (i.e., only the amounts above 0.5% of AGI are deductible), reducing their deductible value.

For example, if your AGI is $250,000 and you contribute $10,000 to charity, you’re entitled to a $8,750 charitable deduction ($250,000 x 0.5% = $1,250 AGI floor - $10,000 contribution = $8,750 deduction).

6). New Auto Loan Interest Deduction

For new, U.S.-assembled vehicles with loans originated after December 31, 2024, up to $10,000 of loan interest may be deducted whether you itemize or take the standard deduction. This deduction is effective for 2025-2028, completely phases out at $149,000 MAGI for single filers and $249,000 for joint filers, and only applies to vehicles with final assembly in the U.S. (you can use the NHTSA Vin Decoder to obtain that information).

For a 5-year, $50,000 loan with a 5.5% interest rate, you would average ~$1,750 of interest annually over the first 4 years—a far cry from the $10,000 limit, but better than nothing.

7). Clean Energy Credits Repealed

Electric vehicles must be acquired by September 30, 2025, to qualify for the clean vehicle credit, which is worth up to $7,500 and $4,000 for new and used vehicles. The residential clean energy credit, which is worth up to 30% of the cost to install solar, wind, or geothermal equipment, can be claimed for improvements installed by December 31, 2025.

8). Increased Estate and Gift Tax Exemption

The 2017 Tax Cuts and Jobs Act (TCJA) doubled the gift and estate tax exemption from $5.6M to $11.2M per person, which now sits at $13.99M (after inflation adjustments). For estate planning purposes, this means that your estate would only be subject to the federal estate tax if the value of your estate exceeds $13.99M.

This higher TCJA limit was set to “sunset” at the end of 2025, reducing the exemption by 50%. Understandably, the exemption potentially getting cut in half has been a hot topic in the world of estate planning since a lot of tax dollars are at stake for families that the change would impact. The good news is that the OBBBA not only preserved the higher exemption but increased it to $15M per person ($30M per couple) starting January 1, 2025, helping to simplify gift and estate tax planning.

Retirement Planning Opportunities Arising from the OBBBA Tax Changes

Understanding the One Big Beautiful Bill Tax Act changes sets the stage, but what really moves the needle for your retirement plan are the steps you take. Here are five tax moves you can put into action right now to benefit from the new law.

1. Review your tax withholdings to avoid over-withholding

The increased SALT cap and standard deduction, along with new deductions, like the $6,000 for taxpayers ages 65+, make it necessary to review your tax withholdings to avoid over-withholding. This is especially true if you live in a high-tax state.

2. Start keeping track of your itemized deductions

Start tracking your itemized deductions (e.g., property tax, mortgage interest, charitable contributions, medical expenses) if you are one of the many taxpayers who switched from itemizing to the standard deduction after the TCJA increased it. The higher SALT cap may warrant switching back to itemizing. And even if you continue to take the standard deduction, remember that you can now deduct charitable contributions.

3. Update your Roth conversion strategy to avoid “stealth” taxes

The new tax law introduces a host of “stealth” taxes, making the math of whether to convert more difficult. Think of stealth taxes as non-obvious ways your tax liability can increase, often due to income thresholds and deduction phase-outs baked into the tax code.

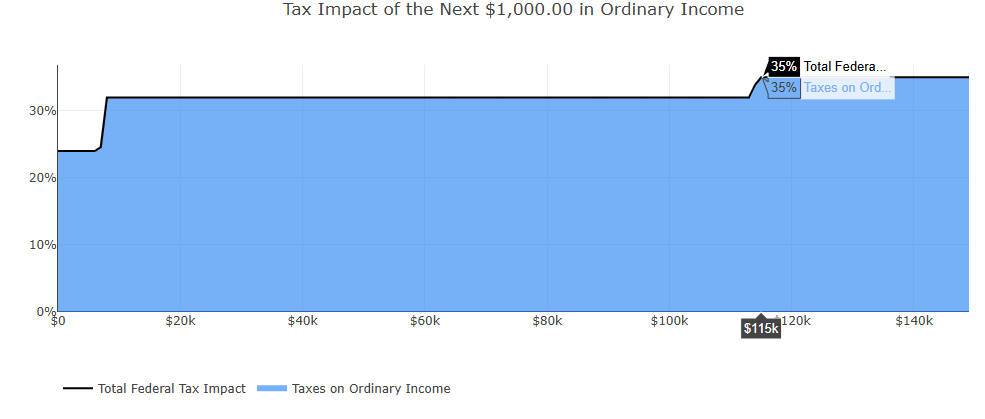

We can see a stealth tax in action in the charts below. The top chart is a pre-OBBBA tax projection showing how much a hypothetical retiree would pay in taxes for each additional $1,000 of ordinary income in 2025 to determine how much they can convert to a Roth IRA to “fill up” the 32% federal tax bracket. As we see, they reach the 35% tax bracket with $115,000 of additional income, meaning they would want to keep the value of the Roth conversion below that amount.

Pre-OBBBA Roth Conversion

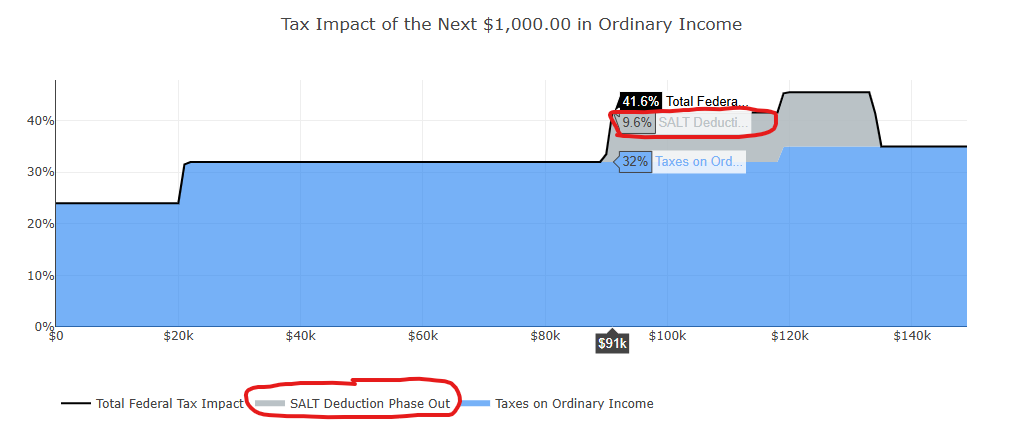

However, if we apply the new OBBBA tax rules, the Roth conversion strategy changes significantly. Because the SALT deduction starts to phase out at $500,000 of MAGI, this retiree's tax rate jumps by 9.6% (representing the lost value of the SALT deduction) with $91,000 of additional income, for a combined federal tax rate of 41.6%! Since the goal was to stay in the 32% tax bracket, this retiree needs to revise their Roth conversion target downward, below $91,000 – $24,000 less than planned. Click here to learn more about Roth IRA Conversion strategies and how to use them to save money on taxes in retirement.

Post-OBBBA Roth Conversion

The takeaway is that if your Roth conversion strategy was developed before the OBBBA was passed, it’s essential to make updates to avoid inadvertently increasing your tax bill.

4. Accelerate itemized deductions to maximize your tax savings

If you plan to make charitable contributions, expect to be in the 37% tax bracket, or both, consider accelerating itemized deductions to the 2025 tax year. If you recall, starting in 2026, deductions for charitable contributions will be subject to a 0.5% AGI floor, and itemized deductions will be capped at $0.35 on the dollar, meaning the value of both deductions will decline. Making multiple years’ worth of gifts to a donor-advised fund, pre-paying property taxes (if allowed by your locality), and making fourth-quarter estimated state tax payments in December are ways to pull deductions into 2025.

5. Buy your electric vehicle (EV) and energy-efficient home improvements

If you’re considering buying an EV, don’t delay. You have until the end of September if you want the clean vehicle credit. As a bonus, you may be able to stack the credit with the new auto loan interest deduction if the EV’s final assembly is in the U.S. and you finance the purchase. You have until the end of 2025 to claim the home energy credit.

For retirement planning purposes, the OBBBA presents a mixed bag. It combines the status quo set by the TCJA with new deductions and phase-outs, along with various effective dates that may create opportunities for proactive retirees. Rethinking your Roth conversion strategy, accelerating deductions, and timing major purchases are just some of the ways to maximize your tax benefits.

The key is not just knowing the rules, but applying them thoughtfully to your unique situation. If you’d like help understanding how the new tax laws affect your retirement plan, click here to schedule a complimentary call with our retirement planning specialists today.