Five Considerations to Determine When to Start Retirement Planning

KEY TAKEAWAYS:

- The optimal time to start retirement planning depends on personal circumstances rather than conventional wisdom suggesting 3-5 years before retirement.

- Understanding the "retirement red zone" and sequence of returns risk is crucial for protecting your financial future during the most vulnerable period of your investing life.

- Early retirement planning enables better decision-making, tax optimization strategies, and provides essential financial security for both spouses.

Conventional wisdom is that one should start retirement planning three to five years before retiring, but if you’ve been following us for a while, you know that we don’t put much stock into “conventional wisdom.” As is often the case, conventional wisdom paints too broad a brush stroke. The truth is that the ideal time to start retirement planning depends greatly on personal feelings and circumstances.

As retirement planning specialists, sometimes we see people start planning for their retirement when they land their first big career, while other times, we meet with those who’ve been putting the process off until just a few years before retirement.

While it is hard to determine exactly when you should start formal retirement planning (without knowing you personally), there are at least five important considerations to make. Determining where you fit within and how you feel about these five areas of consideration will give you a good idea of when it could make sense for you.

1). You’re Nearing (or in) the “Retirement Red Zone”

One of the most important considerations is that you're getting closer to, or are in, the “Retirement Red Zone.” The Retirement Red Zone is defined as the five years before and after retirement that represents the most critical time of your investing life. During this time, losses hurt more because of “sequence of returns risk.” Sequence of returns risk is the exposure you have to the probability that a substantial drop in the value of your portfolio early on, or just before retirement, can adversely affect the overall growth you get from your investments, forever impairing the amount you can withdraw in retirement. This is why it’s extremely important to have a plan and consider meeting with a retirement planning specialist before this critical time. (See our Insight entitled “Critical Risk During the “Retirement Red Zone”” for more)

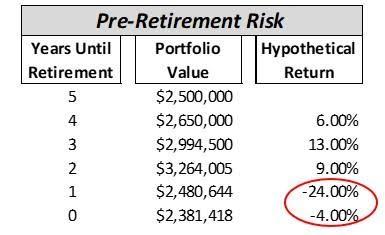

For example, a couple with a current portfolio value of $2.5M decides they need $3.0M to retire and want to work five more years. This couple would only need to earn a 3.71% average annual rate of return to close the gap and meet their goal. Closing this gap sounds easy, given the historical average annual return from a 60% stock and 40% bond portfolio.

Here is where sequence of returns risk comes into play. What if, two years before retirement, this couple experiences the following negative sequence of returns?:

Experiencing this negative sequence of returns so close to the couple’s planned retirement date turned what once looked like an easy glide path into retirement into a shortfall of over $600k by their planned retirement date. This couple now has to work longer or make cuts to their planned retirement lifestyle.

Investment markets don't deliver average expected returns. Rather, they deliver an unknown sequence of returns that yield average expected returns over time. It’s your unknown sequence of returns that matters during the Retirement Red Zone.

The good news is that with proper advance retirement planning, we can manage this risk by employing a number of strategies so that your retirement timing does not have to be determined by the whims of investment markets.

2). You Don’t Have a Plan to Guide Smarter Decision Making

Retirement planning is complex and integrates many variables in an effort to determine an ideal plan that optimizes one’s situation. Having a plan allows you to test the effect of certain financial decisions so you can see the total impact on your retirement (and other) goals. Without a plan, decisions tend to be made in a vacuum and may have unintended consequences elsewhere.

For instance, a common question that arises when it comes to retirement planning is:: “Should I be contributing to my Roth 401k or pre-tax 401k?” The answer is, “It depends.” Without a complete retirement plan picture that includes a long-term tax forecast and strategy, who can say with any certainty? Making the optimal choice for a question like this would require:

- Long-term tax forecasting

- Analysis of current vs. future tax brackets

- Understanding of overall retirement tax strategy

- Consideration of other income sources in retirement

Only a complete retirement plan can provide the context necessary to make this determination with confidence. If you don’t already have a plan that will guide your retirement planning strategy decisions, it’s a sign that it’s time to start your retirement planning process sooner rather than later.

3). You Need to Identify Potential Tax Savings Strategies Available Before Retirement

The time frame leading up to and shortly after retirement often presents prime opportunities to begin executing tax savings strategies. The years just before retirement tend to be prime earnings years, where you may be in the highest marginal tax rate bracket you will experience. Tax deductions are most valuable during this time, making some strategies potentially appealing.

Some key tax planning opportunities may include:

- Strategic Roth conversions during lower-income years

- Maximizing deductible contributions while in high tax brackets

- Implementing tax-loss harvesting strategies

- Planning charitable giving for maximum tax benefit

- Coordinating Social Security claiming strategies with tax implications

Effective retirement planning includes developing a comprehensive tax strategy that spans multiple decades. This involves projecting future tax liabilities and implementing strategies to minimize lifetime tax burden rather than just focusing on current-year savings.

If you haven’t yet considered any of these tax strategies, now may be the right time to start retirement planning.

4). You Haven’t Started Transitioning Your Investment Portfolio for Retirement

Regardless of how far off from retirement you may be, your investment portfolio construction and holdings play a key role in how much investment risk you take. The higher your investment risk, the higher your exposure to a potential negative sequence of returns event (see consideration #1 above).

Ensuring your portfolio is well constructed and diversified is vital to minimizing volatility (and thus sequence of returns risk) as you near retirement. Also, keeping as much return as possible becomes more critical because you cannot afford to take concentrated risks to try and hit home runs anymore. This means paying attention to fees that can eat away at your returns. (See our Insight entitled “Building an Investment Portfolio for Retirement” for more)

As you approach retirement age, it’s also even more important to better manage your investments. This means pulling together those straggler 401ks and consolidating accounts where possible so you can take a full inventory and view everything in light of your holistic financial plan and your retirement goals. Once you have taken stock of everything, you can employ an “asset location” strategy whereby you optimize where you hold each investment holding based on their tax treatment to ensure your investment management is tax optimized.

5). You Need to Provide Stability/Continuity for the Less Financially Savvy Spouse

As retirement planning specialists, we meet with many couples—and we seldom find a couple where financial and investment acumen is spread evenly. While equal partners, one spouse typically leads the charge when it comes to financial matters. This is fine, except if something were to happen to the partner leading the charge.

Formal retirement planning helps ensure stability and continuity for the less financially knowledgeable spouse. Having a trusted relationship with someone competent and a retirement plan that you have collaborated on and understand can go a long way in easing the less financially savvy spouse’s consciousness if they have to step up to the plate and take charge for some unfortunate reason.

This is a big problem and one of the unintentional negative consequences that we see among many retirement do-it-yourselfers (DIYers). Everything is fine as long as the person leading the charge continues to be able to do so. If not, the spouse is left without a plan and trusted advisor and is forced to find help on their own, which is a catch-22.

For every good financial advisor out there who would happily help this spouse, there is another who would readily take advantage. Unfortunately, this spouse probably is not in the best position to determine who is who. If you have a spouse and want to protect them against this risk, the time to start planning for retirement is now.

How to Start Planning for Retirement

So how to start planning for retirement if you find yourself in one of these five camps? You can download our Retirement Readiness Checklist below or simply schedule a call with one of our retirement planning specialists and get a complementary Thrive Assessment to see if you’re on track to meet your retirement goals.