Critical Risk During the "Retirement Red Zone"

Retirement planning is a long-term process that requires careful thought, strategy, and preparation. While many people begin to focus on retirement savings early in their careers, it is during the final five years before retirement that the stakes become especially high.

This crucial period, known as the "Retirement Red Zone," represents a critical phase where both planning and investment decisions can significantly impact the success and direction of your retirement lifestyle.

Before we explain how critical sequence of returns risk is and how to address it before entering the retirement red zone, here are the three main reasons why retirement planning professionals recommend individuals and couples start retirement planning at least five years before they plan to retire.

Determine Target Portfolio Amount Needed to Support Your Retirement Goals

To retire, you must be confident you have the assets needed to support your desired retirement lifestyle for however long it may be needed. A retirement specialist can help you develop a retirement spending plan that reflects and supports your intended lifestyle and goals.

A target portfolio value can then be backed into from your retirement spending plan given your projected resources and a series of spending sustainability testing using Monte Carlo and Historical Simulation Analysis. You can then develop a plan to close the gap between your existing and your target portfolio value by the time you retire.

If you are working with a retirement specialist with the necessary knowledge and technology, performing this spending sustainability testing while overlaying a set of Dynamic Withdrawal Rules can allow for a higher level of spending with the same amount of assets. (See our Insight entitled “Quantifying the Value of Dynamic Withdrawal Rules” for more.)

Create a Tax-Efficient Retirement Income Strategy

Because you will likely retire with many different asset types (i.e., taxable, pre-tax, Roth, home equity, etc.), how you use these assets and the order/mix in which you use them can have enormous implications.

Developing a retirement income strategy that minimizes lifetime taxes can add material value to your retirement plan. The five years before retirement may present an opportune time to begin executing on some elements of your retirement income strategy.

Some of these opportunities include Roth IRA conversion strategies, funding a Donor Advised Fund (DAF), and more that, when strategically used, allow you to reach your goals and later income needs in the most tax-efficient way possible. (See our Insight entitled “Developing a Retirement Income Strategy to Minimize Lifetime Taxes” for more.)

Manage Investment Risk During the Retirement Red Zone

The last reason, and the subject of this Insight, is that long-term investing in the accumulation stage is quite different than pre- and post-retirement investing. The stakes are much greater as you near retirement. Your retirement portfolio asset allocation and investment selection may need to be slightly more conservative as you may not be able to afford the short-term losses you could when you were younger because you may not have time to recover from them.

The Key Risk in the “Retirement Red Zone”: Sequence of Returns Risk

Prudential Insurance coined the term “Retirement Red Zone” to represent the five years before and after retirement. In this Retirement Red Zone, losses hurt more because of “sequence of returns risk.”

Sequence of returns risk is the exposure you have to the probability that a substantial drop in the value of your portfolio early on, or just before retirement, can adversely affect the overall growth you get from your investments.

Sequence of Returns Risk Example: Five-Years Before Retirement

In the final five to ten years leading up to retirement, your portfolio’s value is primarily determined by its volatility and returns. As a portfolio compounds and grows larger over time, the relative impact of contributions is less and less.

Now add to this the fact that markets do not deliver average investment returns yearly. Instead, the market delivers a sequence of annual market returns that, over time, approximate the average returns accumulators had long relied upon to save for their retirement. You can no longer rely on forecasting average returns with only five years to go.

Rather, you have to be prepared to receive an unknown five-year sequence of returns, that depending upon your portfolio’s construction, cost, and volatility, can vary widely.

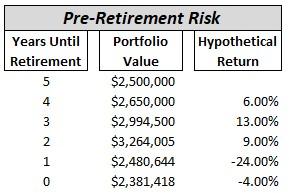

For example, say a couple is five years from planned retirement with an investment portfolio of $2.5M. Working with their retirement specialist, they determined that $3.0M would be the proper portfolio target to support their desired retirement lifestyle.

In this case, assuming no contributions to simplify the example, this couple would only need to earn a 3.71% average annual rate of return to close the gap and meet their goal. Closing this gap sounds easy, given the historical average annual return from a 60% stock and 40% bond portfolio. Here is where sequence of returns risk comes into play when doing income planning for retirement.

What if, two years before retirement, this couple experiences the following negative sequence of returns?:

Experiencing this negative sequence of returns so close to the couple’s planned retirement date turned what once looked like an easy glide path into retirement into a shortfall of over $600k by their planned retirement date. This couple is now left with three options.

First, they can continue to work longer and hope their portfolio value recovers in time. It would take a 25.98% annual return to close the gap in one year, a 12.24% average annual return to close the gap in two years, and an average annual return of 8.00% to close the gap in three years.

Second, they can make drastic cuts to their planned retirement lifestyle.

Third, they could pursue a combination of both the first and second options. None of these choices are desirable.

The critical point to remember is that markets don't deliver average expected returns - they deliver an unknown sequence of returns that yield average expected returns over time.

It’s your unknown sequence of returns that matter during the Retirement Red Zone. Because of this, pre- and post-retirement investing require a different approach from simply investing for the long-term as you did during your accumulation stage.

Sequence of Returns Risk Example: Five-Years After Retirement

Risk is also heightened during the five years after retirement. When a retired couple begins making withdrawals from their portfolio to fund their retirement expenses, they run the risk that early returns could be too low for too long and that ongoing withdrawals could materially deplete the portfolio before the better returns finally arrive. Again, it is the sequence of returns that matter.

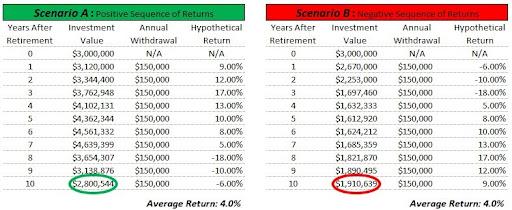

Carrying forward our example, let’s say that thanks to the help of their retirement planning specialist, our couple in the previous example was able to avoid a negative sequence of returns before retirement and met their $3.0M portfolio value target.

Since they hit their $3.0M target, they felt comfortable retiring and beginning to withdraw $150,000 (5%) per year from the portfolio to fund retirement living expenses. The problem is that you can only avoid a negative sequence of returns for so long, and it now hits them just after retiring.

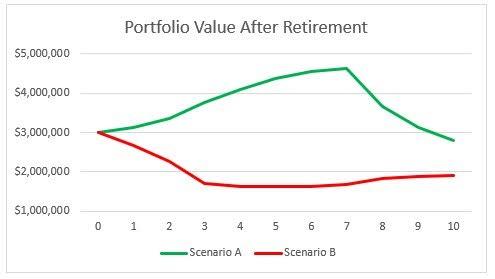

The following two scenarios show us how devastating this can be:

The negative sequence of returns experienced early in retirement, as modeled in Scenario B, results in a 32% (or $890k) lower portfolio value after just ten years, even though both scenarios yielded the same 4% average annual return. (Note – the hypothetical returns in the two scenarios are the exact same returns in the opposite order to highlight just how much the sequence matters.)

How to Manage This Key Retirement Red Zone Risk

The good news is that we can take steps to manage and partially mitigate risk exposures, including the sequence of returns risk, during the Retirement Red Zone. It starts with optimizing your investment portfolio.

If you are approaching the Retirement Red Zone, now is the time to minimize volatility by revisiting your asset allocation decision and portfolio's construction.

High-cost active investments and individual stocks should be replaced with low-cost, maximally diversified index funds (of course, while being sensitive to the impact of gains in taxable accounts).

Now is not the time to make active concentrated bets. Not only does your portfolio’s volatility increase dramatically, but you also run the risk of missing where the returns are coming from in the market in any given year.

Your portfolio must be efficient, yielding the highest possible return given the risk taken. (See our Insight entitled “Building an Investment Portfolio for Retirement” for more)

The next step is to pay close attention as you approach retirement and have a plan if things go south. Having a plan in place allows you to have adequate non-market invested savings and/or other non-market invested assets (i.e., home equity, etc.) that you can use while riding out a negative sequence of returns event. You can tap those other assets while waiting for your invested financial assets to recover before retirement instead of postponing or making cuts.

Further, sequence of returns risk is limited to situations where ongoing cash flow distributions are coming out of the portfolio. If during a negative sequence of returns event we stop withdrawing from the portfolio after retirement, we allow all the dollars that experienced a decline to participate in the subsequent recovery thereby neutralizing the negative effect. Planning ahead for the potential setbacks a negative sequence of returns event can have is a far better choice than hoping for the best and then being forced to work longer and/or cut back on your standard of living in retirement.

If you would like our help guiding you through the Retirement Red Zone, we stand by ready to help. To learn more, you can schedule a friendly, informal call with a retirement planning specialist or request your Complimentary Thrive Assessment here.