How to Do a Roth IRA Conversion to Hedge Against Higher Future Tax Rates

KEY TAKEAWAYS:

- A Roth IRA conversion can help hedge against future tax increases by locking in today’s lower tax rates before they potentially rise in the future.

- Converting part or all of a traditional IRA to a Roth IRA gives you more flexibility in managing retirement withdrawals and minimizing lifetime taxes.

- A well-timed Roth IRA conversion strategy can reduce required minimum distributions (RMDs) and pass more tax-free wealth to your beneficiaries.

We have all heard the line, "there are only two things in life that are certain: death and taxes." While there is nothing we can do about death, there are fortunately some strategies we can employ to manage or, in some cases even, completely eliminate future tax liabilities. As retirement planning specialists, one of the key tools that we use to help our clients have a more tax-efficient retirement plan is the Roth IRA.

Here, we define what exactly a Roth IRA is and explore how a Roth IRA conversion from a traditional IRA (or from a rollover IRA) could benefit you as you transition into your retirement years.

To set the stage, let’s start with an overview of the difference between a Roth IRA and a traditional IRA.

How is a Roth IRA Different From a Traditional IRA?

A traditional IRA (Individual Retirement Account) is funded with pre-tax dollars that are allowed to grow tax-free until they are withdrawn. When traditional IRA funds are withdrawn, the total amount of the withdrawal is included as income in the year taken and taxed at your personal marginal income tax rates.

Traditional IRAs are also subject to required minimum distributions (RMDs) once an individual turns 72, 73, or 75 (depending on your year of birth), whether the person is retired or not. This means that they have to withdraw a portion of their IRA every year (based on a formula set by the IRS) and then pay taxes on that withdrawal. For individuals who need the total amount of their RMD to support living expenses, RMDs do not present an issue. RMDs do, however, present an issue for individuals who do not need the total amount of their RMD to support their living expenses but are forced to withdraw the money and pay taxes on it anyway.

A Roth IRA is distinctly different from a traditional (or rollover) IRA because of the account type's unique taxation characteristics. A Roth IRA is funded with after-tax dollars but allows investments to grow tax-free without further taxation when withdrawn. When Roth IRA funds are withdrawn, they are not included in your income for tax calculation purposes. It is like taking after-tax money from your savings account. Additionally, Roth IRA's are not subject to required minimum distributions (unless the IRA was inherited).

How Having a 401(k) or 403(b) Often Leads to (Eventually) Also Having an IRA

Many people never contribute directly to a traditional IRA but end up with IRA assets anyway. This happens when people contribute to their employer-sponsored 401(k) or 403(b) while working to take advantage of company matching benefits and pre-tax investment compounding identical to the benefit within a traditional IRA. When people retire, they typically roll over their 401(k) or 403(b) to an IRA. A rollover IRA is the same as a traditional IRA when it comes to taxation and RMD requirements. The only real distinction between a traditional IRA and a rollover IRA is in how the IRA was initially funded.

Some companies may offer the option to contribute to a 401(k) on an after-tax basis so that the withdrawals are treated the same as a Roth IRA for tax purposes.

So if you have a traditional or a rollover IRA, when and why would it make sense for you to do a Roth conversion?

Who Qualifies to Do a Roth IRA Conversion?

The Roth IRA becomes a powerful tool when used within the context of a properly constructed Roth IRA conversion strategy. During working years, many people focus on trying to maximize their funding to employer-sponsored plans. By the time they have enough income to do so, they often find they are phased out of being able to contribute any excess savings to Roth IRAs given Adjusted Gross Income limits of $150,000 if single and $236,000 for couples as of 2025.

So how then can a person fund a Roth IRA? This is where a Roth IRA conversion comes into play.

There is often a lot of confusion when it comes to Roth IRA conversions. Many think they are ineligible to fund a Roth IRA based on earned income limitations or being phased out by their income level. While this is true when it comes to contributing to a Roth IRA, there are no limitations when it comes to converting traditional (or rollover) IRA assets to a Roth IRA. There is no Roth IRA rollover limit.

Any amount of IRA assets can be converted to a Roth IRA in any year, so long as you recognize the withdrawal amount as income in the year withdrawn and pay taxes according to your marginal income tax levels. The tax implications are the same when you do a 401(k) to Roth IRA conversion.

Determining how much and when to convert (if any) lies at the heart of constructing a proper Roth IRA conversion strategy. The analysis is based on a number of factors and is sensitive to a person's unique situation.

Why a Roth IRA Conversion Makes Sense When Tax Rates Are Increasing

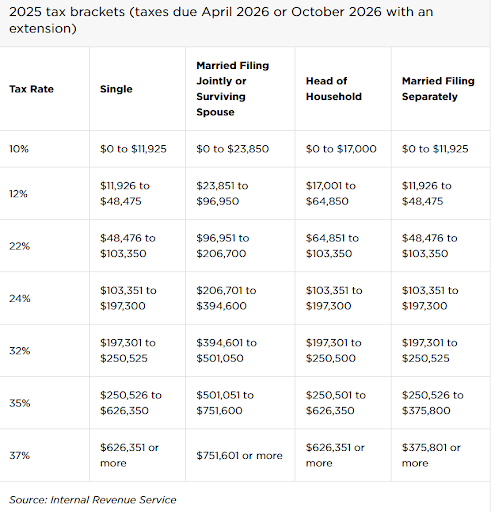

One such factor aiding the math for many is that today's lower marginal income tax rates under the Tax Cut and Jobs Act (TCJA) are set to expire in 2026 (unless Congress acts to change this). At expiration, marginal tax rates are set to revert to the previous higher levels. The difference in personal marginal income tax rates and income thresholds is substantial as can be seen from comparing the charts below:

If the TCJA indeed expires in 2026, then it might be wise for those with a traditional IRA to still convert as much of it into a Roth IRA as possible without moving them up into higher tax brackets. Even after 2026, depending on your goals, it might still be worth exploring a Roth IRA conversion to accelerate the payment of taxes and therefore avoid that payment in later years when taxes may rise even further.

If, before the end of 2025, Congress acts to extend the TCJA, a multi-year Roth conversion strategy could be of benefit to many. This simply means converting a portion of your IRA into a Roth IRA up to some specified marginal bracket each year and paying taxes on it. By converting some amount of IRA assets and realizing some amount of income each year, the individual can pay income taxes based on the current lower income tax rates and avoid having to realize the income after income tax rates increase.

Benefits of a Roth IRA Conversion Strategy

Aside from the obvious benefit of paying income taxes now while personal marginal income tax rates are lower than paying them later when rates are higher, there are several less obvious benefits to a Roth IRA conversion strategy as well.

Optimize Retirement Withdrawals to Minimize Taxes

For beginners, having assets invested in a Roth IRA in addition to an IRA allows you to coordinate withdrawals later to keep yourself just under your highest marginal income tax bracket. For example (ignoring exemptions and other income), assume in 2025 you needed $120,000 from your IRA to help fund your living expenses. Your marginal income tax rate would be 22% if married filed jointly. You would pay 10% on your first $23,850, then 12% on the next $73,100 and finally 22% on your last $23,050. Altogether, your tax bill would be $16,228 But say you funded that last $23,050 from your Roth IRA instead of your traditional IRA, you would reduce your tax bill by 31% and save $5,070. Having sufficient assets in a Roth IRA allows you to create an optimal tax-efficient strategy of ongoing withdrawal coordination to minimize the amount of taxes you pay over your lifetime.

Lower Your RMDs

For those who wonder how to avoid RMDs altogether, the easy answer would be to convert their IRA into a Roth before the time that they’re required to start taking RMDs. But even if you don’t convert your entire IRA, you can also lower the amount of your RMDs by converting at least a part of your IRA assets to a Roth IRA. This reduces the amount of assets left in your traditional IRA accounts that are subject to RMD rules. By lowering the amount of assets in your traditional IRA, you can lower your RMD to a level such that you do not have to recognize income and pay taxes on money that is not needed.

Pass More Wealth Onto Your Beneficiaries

Lastly, a Roth IRA conversion strategy can also be used to pass more wealth on to beneficiaries in a tax-efficient way. If you were to leave your traditional IRA assets to your beneficiaries, they would have to withdraw the assets within ten years of your date of death and pay income taxes on the amounts withdrawn in the years taken. There might be two problems with this. First, your beneficiaries might be in a higher marginal income tax bracket than you are given they are still in their working years. Second, your beneficiaries will have to pay taxes on the ten years of capital growth on the assets.

If your beneficiaries are in higher marginal income tax brackets than you, paying taxes at your lower rate to convert the assets to a Roth IRA allows the assets to pass and not be taxed at your beneficiaries' higher tax rate later. Additionally, the assets can grow tax-free for ten years before your beneficiaries must withdraw the assets. The end result could be additional material wealth being passed to your beneficiaries.

One of the three smart tax and investment moves we recommend during a turbulent market is actually doing your Roth conversion to take advantage of converting a large chunk of your pre-tax retirement account without entering a higher bracket.

When to Start Planning a Roth IRA Conversion Strategy

Conventional wisdom is to start retirement planning at least five years before your planned retirement age. The main reason for this is to allow time to develop and take advantage of strategies such as creating a Roth IRA conversion strategy. Time is your friend when planning for retirement.

While a Roth IRA conversion strategy may always make sense for some people in certain circumstances, today's lower Tax Cut and Jobs Act personal marginal income tax rates in place until 2026 create a particularly attractive opportunity for many. Another time the strategy may become particularly attractive is just before retirement if you have a year or two of low realized income between leaving work and beginning retirement. Filling in those lower marginal income tax rate brackets by converting can be beneficial. Lastly, the first few years into retirement can also be an opportunity for some. Typically speaking, the longer the time period the Roth IRA assets have to grow, the sweeter the math becomes.

While a Roth IRA conversion is an important strategy when it comes to managing your taxes, it is not the only one. Read our Insight entitled, “Strategies to Manage Taxes in Retirement” to learn more about other tax management strategies. Planning a Roth IRA conversion strategy can be complex, which is why it’s best to consult a retirement planning specialist. If you are ready to begin planning for retirement and would like to explore potential Roth IRA conversion strategies, click here to get your Complimentary Thrive Assessment.