Retirement Tax Planning: Why You Can't Have a (Good) Retirement Plan Without a Tax Plan

TAKEAWAYS:

- A tax plan is an overarching tax strategy that aims to minimize your lifetime tax bill.

- Your tax plan informs many critical retirement planning decisions.

- A well-crafted tax plan can lead to materially more wealth during retirement and a retirement plan can’t be optimized without it.

Many people devote decades to picking funds, rebalancing portfolios, and chasing performance, yet they leave taxes—often the largest lifetime expense—largely to chance. But having a retirement plan without a tax plan is like being left with a map and compass that doesn’t work.

It is the tax plan that informs the retirement plan, and that helps us to make the most of potential retirement planning strategies to help you live a comfortable life in retirement without having to make unnecessary trade-offs

What is a “Tax Plan”?

A tax plan is an overarching tax strategy that aims to minimize your lifetime tax bill by looking at your situation today and figuring out the most tax-efficient path going forward, given your specific circumstances and assumptions. The term “lifetime tax bill” is key.

What good is minimizing today’s tax bill if future tax bills will bite harder, especially in retirement when you may be relying on limited sources of income?

As retirement planning specialists, we always make sure that each client has a tax plan that works with their overall financial plan and that they pivott when tax codes inevitably change from time to time. Because Congress rewrites the rules every few years, your tax plan must move with the headlines. The looming sunset of the Tax Cuts & Jobs Act at the end of 2025, for example, may lift today’s 22 percent bracket to 25 percent overnight. Acting before that hike could make a large difference in your overall retirement outcomes.

Because we are forced to work with unknowns and uncertainties, your tax plan is part art and part science.

How Having a “Tax Plan” Affects Every Aspect of Your Retirement Plan

Planning retirement income or putting together a solid retirement spending plan is nearly impossible without taking tax consequences into consideration. Many critical retirement planning decisions are informed by your tax plan,

such as:

- Should I make traditional or Roth contributions to my 401k?

- Should I execute a Roth IRA conversion strategy, and if so, how much each year and for how long?

- Should I sell low-cost basis holdings in my brokerage account to fund retirement expenses?

- Could I benefit from funding a Donor Advised Fund (DAF) and how should I fund that?

- Which account should I start funding retirement from, or should I take a certain proportion from a certain mix (i.e., withdrawal ordering strategy)?

- Would I benefit from tax-loss or gain harvesting?

- Should I gift to my children, and if so, how?

You can not answer these questions without a firm understanding of your current tax situation and a sense of your future strategy. The correct answers are almost entirely dependent on your tax plan.

How a Tax-Efficient Withdrawal Strategy Can Make All the Difference

While each of the questions above would take a complete Insight to explore, we can take a look at the withdrawal ordering strategy question (which includes an element of a proper Roth IRA conversion strategy) as an example.

How you save between your pre-tax retirement, after-tax brokerage, and never-again taxed Roth IRA accounts and the strategy you use to fund your retirement living expenses from these various accounts can have an enormous impact on the amount of wealth you can withdraw during retirement.

Retirement Tax Planning Case Study

In the example below, (closely based on an actual client’s situation), you have a 59-year-old single person with a 37-year plan duration (assuming a life expectancy of 96). This person has a little over $5 million saved, with a little less than half in after-tax brokerage savings and a little over half in pre-tax retirement savings.

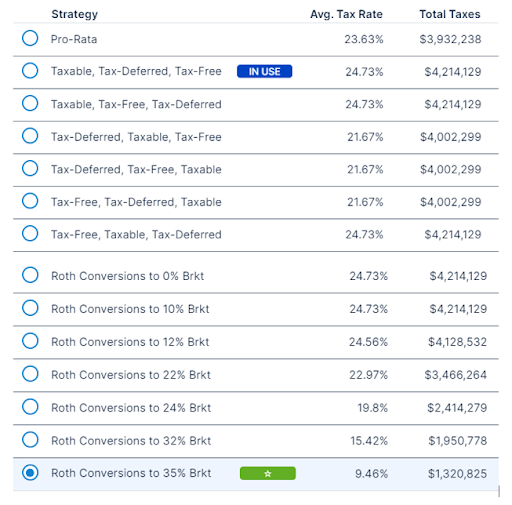

When we take a look at potential retirement withdrawal strategies, you can see the material economic difference each strategy presents:

The worst strategy, in this case, happens to be a widely known and too often blindly recommended withdrawal strategy known as “conventional wisdom” (side note – this is why we hate “rules of thumb”).

By exhausting the brokerage accounts first (i.e., taxable) before going into the pre-tax retirement (i.e., tax-deferred) accounts, this person would experience an estimated average tax rate of 24.73% and a lifetime tax bill of approximately $4.2 million.

So, what might be the optimal retirement tax planning strategy for them?

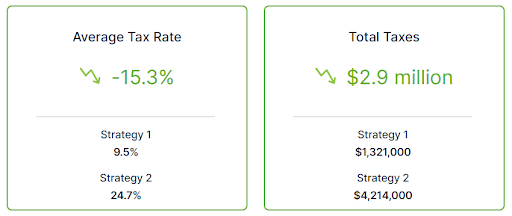

The best strategy in this case is a Roth IRA Conversion strategy targeting the 35% marginal bracket. In this case, this strategy would yield an estimated average tax rate of 9.46% and a lifetime tax bill of approximately $1.3 million. This presents a striking difference between these strategies of:

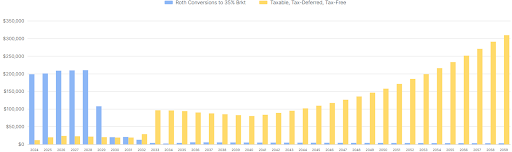

As you can see below, this strategy (in blue) does not lead to the lowest tax bill this year. In fact, tax bills will be higher in each of the next six years. But after the Roth conversion strategy pulls forward the tax recognition of the pre-tax retirement balances and those balances are shifted to the Roth IRA account where they can continue to grow for the next 30+ years without ever being taxed again, the tax bill falls materially beyond those six years.

In a case like this, it’s of course important to consider your projected life expectancy along with your estate planning and legacy goals as well. All the more reasons why your financial advisor should also be a retirement planning specialist.

Following the conventional wisdom strategy (in yellow) would have this person pay attention to near-term tax bills at the expense of ignoring future tax bills as they simply pull from after-tax brokerage savings and let the pre-tax retirement accounts continue to grow and compound for another 16 years before Required Minimum Distributions (RMDs) eventually force this person to start taking distributions. These IRS-forced taxable distributions are large by this time, resulting in substantial tax bills.

Build a Tax Plan Into Your Retirement Plan Today

Retirement tax planning is but a part of a well-crafted tax plan. While there are many strategies you can utilize, such as exploiting marginal tax rates, this is just one example to show how valuable and important having a tax plan can be. A retirement plan just can’t be optimized without it.

Our retirement planning specialists can help review and optimize your plan to minimize your lifetime tax bill and ensure your retirement plan is on track. Schedule a complimentary call with us today!