Wield Your Retirement Hatchet (and Put the "4% Rule" On the Chopping Block)

TAKEAWAYS:

- There's no one "safe" portfolio withdrawal rate in a realistic retirement income plan despite the often cited "4% Rule."

- Focusing on withdrawal rates ignores the interplay between lifetime portfolio and non-portfolio income, resulting in unnecessary spending sacrifices during the years retirees prefer to spend more -- early retirement.

- Reality-based retirement income plans recognize that portfolio withdrawal rates tend to decrease over time, allowing retirees to "take more now, and less later," which better aligns with their spending preferences.

When it’s time to start drawing an income from your portfolio, it can be hard to know where to start without worrying that you’ll take too much and run out of money - or too little and not be able to have the lifestyle you truly want.

As retirement planning specialists, we often meet with individuals who have been told that there is only one approach to a safe retirement withdrawal rate.

Here, we talk about why the classic 4% withdrawal rate rule falls short and how the retirement hatchet approach can offer a much more flexible and dynamic withdrawal strategy.

The "Safe" Retirement Withdrawal Rate Refresher

Withdrawal Rate % = Annual Portfolio Withdrawals / Portfolio Balance

Is there such a thing as a “safe” withdrawal rate for retirement? One that will allow a retiree to take out a certain amount of money without having to worry about running out?

In order to find out, William Bengen performed a groundbreaking study in 1994, called "Determining Withdrawal Rates Using Historical Data." In a nutshell, Mr. Bengen answered the question: What was the highest withdrawal amount, as a percentage of investment portfolio assets, that would have been sustainable for the worst-case 30-year period going back to 1926?

The answer – about 4%, which would have been for a new retiree in 1966.

Since this study and the resulting 4% Withdrawal Rate Rule have been written about ad nauseam, we won't get into the details (but you can here). Instead, the key point we want to emphasize is that even though Mr. Bengen's insights are a giant leap forward for retirement income planning because they show why thoughtfully preparing for "sequence of returns risk" is hugely important, applying this retirement withdrawal rate "rule" doesn't work in reality. (See our Insight entitled "Critical Risk During the "Retirement Red Zone" for more)

Why Go Against the Conventional Retirement Withdrawal Rate “Wisdom”?

Our clients are often in disbelief when they learn how much we believe they can sustainably spend in retirement. We usually trace their reaction to all their reading on safe withdrawal rates and the 4% Withdrawal Rate Rule, which are cemented in the retirement planning lexicon.

As a result, their expectations are anchored to the conventional wisdom that says they should only withdraw about 4% of their investment portfolio in any given year.So it comes as a surprise when we encourage them to withdraw 7%.

A retirement planning specialist recommending that they take out nearly double the conventional rule? Yes, you heard us correctly.

So, how is it possible that a 7% retirement withdrawal rate could be sustainable?

To answer that question, it helps to look at two assumptions used to arrive at the 4% Rule (this is by no means an exhaustive list):

- Portfolio-only income. The study eliminated Social Security and pensions, assuming all cash flow must come from investments.

- Fixed, real spending. Withdrawals rose with CPI forever—even though research shows retirees naturally spend less after the “go-go” 60s.²

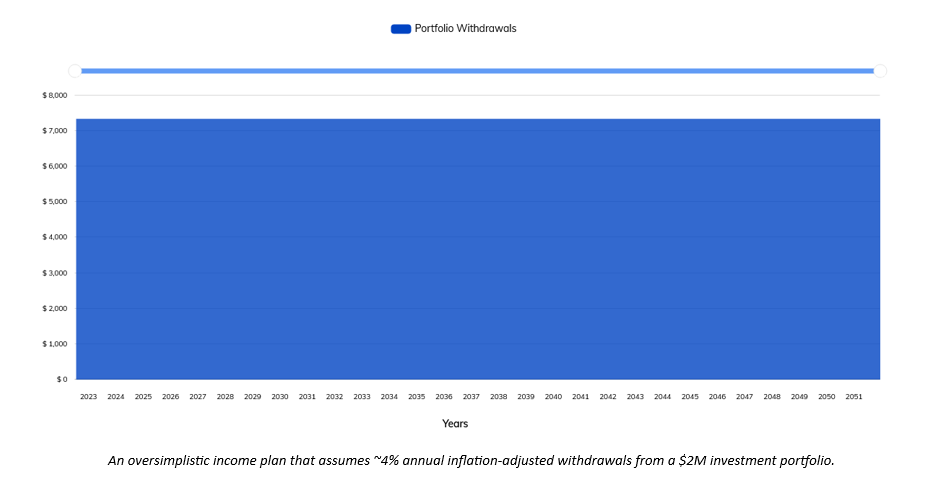

Because these two assumptions aren’t realistic, it doesn’t make sense to rely on them when trying to determine your retirement withdrawal rate. We have charted what a hypothetical retiree's cash flow would look like using these assumptions to visualize this.

How does this example compare to your situation? Probably not well if you're like most retirees. Here’s why:

Multiple Sources of Retirement Income

In reality, retirement income flows are much messier since retirees typically have a mix of income sources that occur over different periods. Common examples include social security benefits, pensions, and part-time work.

Retirement Spending Smile

To further muddy the waters, research by David Blanchett CFP®, CFA (Exploring the Retirement Consumption Puzzle) suggests that inflation-adjusted spending actually declines by about 1% per year during retirement, even when accounting for healthcare costs.

This change in spending is referred to as "The Retirement Spending Smile" and can be attributed to retirees spending less as they age and slow down, which is in stark contrast to the constant inflation-adjusted withdrawals used to arrive at the 4% Rule.

Enter The Retirement Hatchet

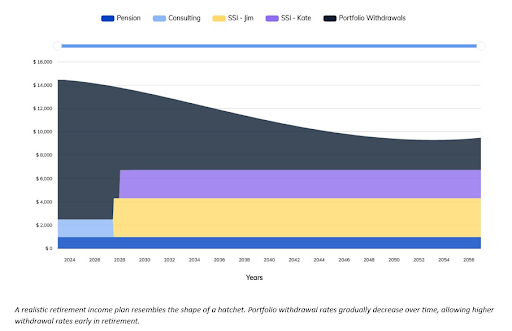

An alternative, and more dynamic withdrawal strategy, is to look at what a more realistic income flow might look like for a retired couple. When we chart more realistic income flows and a gradual decrease in spending as our hypothetical retirees, Jim and Kate, get older, the "retirement hatchet" takes shape.

Think of the hatchet handle as all the guaranteed income that you might receive in retirement, while the blade is made up of dynamic portfolio withdrawals that are designed to shrink over time.

A Reality-Based Retirement Income Plan:

What's striking about this example is the 7% withdrawal rate from the investment portfolio in 2023 ($12,000 per month / $2M portfolio = ~7%)! While that may seem like a very high withdrawal rate, you will quickly see that once Jim and Kate begin collecting their social security income a few years into the plan, and assuming they slowly spend less as they get older, the need for portfolio withdrawals (and their withdrawal rate) significantly declines. In fact, their portfolio withdrawal rate drops to about 1% in the last year of the plan.

As long as they have a plan to address any potential sequence of returns risk at the beginning of this withdrawal period, Jim and Kate can draw more from their portfolio now while they're still energetic enough to live a life filled with adventure and travel, just as they envisioned. The retirement hatchet becomes a tool that molds with their actual income sources and income needs as they get older.

Of course, they could decide to stick with conventional wisdom and apply the 4% Withdrawal Rate Rule instead, reducing their portfolio withdrawals (and total income) in 2023 by about $64,000. But, while that may be good news for their heirs, it's an unnecessary sacrifice.

Click here to read more about the tradeoffs of 3 popular retirement withdrawal strategies.

Conventional planning leads to conventional retirements. If you believe you have earned more than convention and want to map out best withdrawal strategy for your situation, click here to schedule a Complimentary Thrive Assessment and have an informal chat with one of our retirement specialists to help you make the most of your retirement.