To Risk or Not to Risk: Considering the Upside of Sequence of Returns Risk

Key Takeaways

- Traditional withdrawal rules protect against running out of money but often force retirees to spend too conservatively early on.

- Total Risk-Based Guardrails let retirees start higher, then adjust spending up or down based on actual portfolio performance.

- This approach balances downside protection with the ability to enjoy more freedom and quality of life in retirement.

Traditional retirement planning has always been concerned first and foremost with a retiree’s risk of running out of money prematurely. Obviously, under no circumstance can a retiree be allowed to take excessive risk that could subject them to running out of money.

As retirement planning specialists, we recognize that running out of money is clearly the worst outcome a retiree could experience. Therefore, this becomes the greatest risk we must help our clients manage. But effective planning isn’t just about guarding against the downside; it’s also about positioning yourself to benefit from the upside.

While it’s true that it’s important to protect your portfolio against risks like sequence of returns risk, it’s also important to recognize the other side of the coin: when early returns are strong, retirees may actually have more room to spend, gift, or enjoy their wealth sooner. Let’s explore this idea further and provide an approach that can help you be prepared for all retirement scenarios.

The Limits of Worst-Case-Only Retirement Planning Strategies

The retirement planning industry’s almost singular focus on managing this risk has led to the development and adoption of advising along the lines of some very conservative strategies for retirement withdrawals. Some people are told they should simply live off a portfolio’s income. Some people are advised to follow a conservative steady withdrawal rate percentage, like suggested by the “4% rule.”

Another popular retirement planning methodology is to use Monte Carlo simulation modeling to figure out how much one could spend with inflation adjustments, given a certain level of confidence. For instance, you can spend $X for your entire retirement, inflation-adjusted, with a 95% probability of success (or 5% probability of failing, whatever “failure” actually means in this context).

The common thread among all these withdrawal strategy approaches is that they are designed to help a retiree avoid running out of money in the event they experience one of the worst-case scenarios imaginable at any and all cost. Another common thread is that financial advisors who charge based on the size of your portfolio can claim they are meeting their fiduciary duty to you by ensuring you don’t run out of money, while also profiting as your portfolio most likely continues to grow through retirement while following such conservative strategies. (Learn more in our Insight entitled The Hazard of Retiring While Paying an Advisor a % of Your Portfolio.)

Why Flexibility Matters More Than Only Conservatism

While we must plan for the extreme downside scenarios that can occur, we do not believe planning should stop there. We believe that we should also plan for the more probable outcome of not experiencing a worst-case scenario. Additionally, we feel the price of starting retirement out with such a conservative withdrawal strategy is too steep.

The more conservative the withdrawal strategy, the lower your level of initial withdrawal (and thus retirement spending). Ideally, you want to be able to spend more during the early stages of retirement while you are relatively young and healthy and most able to enjoy the benefits your financial resources can provide.

Fortunately, there is a customizable modeling framework that allows us to balance all of these seemingly competing objectives: Total Risk-Based Guardrails.

We cannot know in advance what the path (or sequence) of returns will look like for your investment portfolio. You could end up following a path of returns in the bottom 5th percentile, but you could also end up following a better path of returns. This is known as the sequence of returns risk. Based upon your willingness and ability to be flexible in making changes to your spending in retirement if required to do so, you can choose amongst a reasonable level you’d like to target between 0% (the worst-case simulated scenario) to 40% (40th percentile simulated scenario).

Example of Total Risk-Based Guardrails in Action

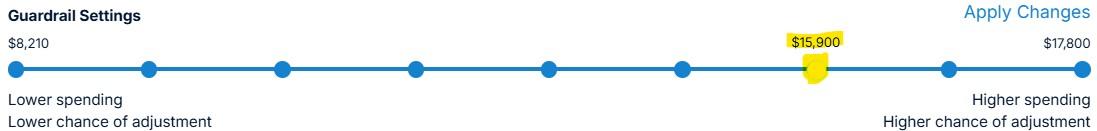

Below is an example of what the total risk-based guardrails retirement planning approach might look like. The more conservative you want to be (i.e., the less willing you are to make a spending adjustment downward if required in the future), the lower your starting withdrawal level (i.e., spending) must be.

Taking the most conservative route and assuming you will follow the worst-case simulated scenario, the retiree in our example scenario, with about $3.2 million in his portfolio, would have to start at a withdrawal amount of $8,210/mo after taxes. At the other extreme (but still within the range of reasonableness for retirement modeling), this person could start at $17,800/mo after taxes if willing to make adjustments downward if their path of returns ends up being below the bottom 40th percentile of simulated scenarios (which still leaves a 60% chance of following a better path).

This person selected to target a 30th percentile of simulated scenarios, and thus will start withdrawals at $15,900/mo after tax.

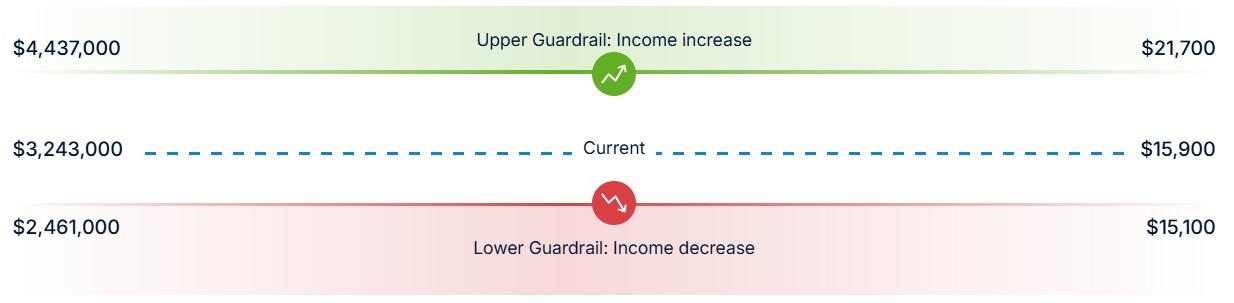

Upper and lower guardrails can now be placed around the initial spend that tell us when increases are warranted (i.e., the actual path followed to date is better than the assumed target) or if you’ll need to decrease spending (i.e., the actual path to date has fallen too far below the assumed target).

As shown below, the initial spend of $15,900/mo was based on a $3,243,000 portfolio. If the portfolio value grows and exceeds $4,437,000 (+37%), spending can be increased to $21,700/mo. If the portfolio value falls below $2,461,000 (-24%), spending would have to be reduced to $15,100/mo.

Capture the Upside While Staying Protected

Maximizing quality of life while healthy and able, and knowing when a positive sequence of returns has benefited you, is equally important if your goal is to make the most of your retirement years.

We utilize Total Risk-Based Guardrail modeling to help our clients begin with a higher level of spending, commensurate with their willingness and ability to be flexible with their spending. We also use Total Risk-Based Guardrail modeling to guide our clients on when a positive sequence of returns has put them in a position to increase their spending or gifting, while still protecting them from the downside scenarios by informing them when a decrease in spending is required, so they don’t risk running out of money.

Total Risk-Based Guardrail modeling grants our clients much greater control and transparency, eliminating the need to rely on simplistic traditional retirement planning approaches that are overly conservative, and make no consideration for scenarios better than the worst case they are designed to withstand.

Curious how this approach could help you plan for your retirement spending confidently while protecting your long-term income? Schedule a complimentary conversation with one of our retirement planning specialists today.