Thinking About a Roth Conversion? Avoid These 3 Costly Mistakes

KEY TAKEAWAYS:

- Stealth taxes, such as deduction phaseouts and Medicare surcharges, raise the true cost of a Roth conversion.

- How you pay the Roth conversion tax bill can dramatically affect long-term tax-free growth.

- Converting too much can backfire by increasing lifetime taxes and reducing the after-tax legacy left to heirs.

Are you considering converting some of your IRA or 401(k) assets to a Roth IRA? If so, you’ve probably heard of the benefits of doing a Roth conversion. (To learn more about the basics of Roth Conversions and how to do one, see our Insight entitled “How to Do a Roth IRA Conversion.”)

Roth conversions are often seen as a simple way to reduce taxes in retirement. But the conversion decision is nuanced, especially for retirees with significant savings and exposure to evolving tax rules.

Given the complexities, it’s easy for retirees to unintentionally reduce the value of a Roth conversion by overlooking the interplay between taxes and their retirement plan. As retirement planning specialists, we aim to find ways to help you preserve more tax-free growth in a way that aligns with your retirement goals. Here, we’ll share three common Roth conversion mistakes we see people making and how you can better plan to avoid making these mistakes.

1). Not Considering Stealth Taxes

The US Tax Code is rife with “stealth” taxes that are periodically changing and challenging to track. Stealth taxes are all the indirect ways your tax burden can increase, often without your marginal tax rate increasing. It’s kind of like the baggage fee that’s not included in the airline ticket price. But based on our experience, airlines have nothing on Uncle Sam when it comes to hidden costs.

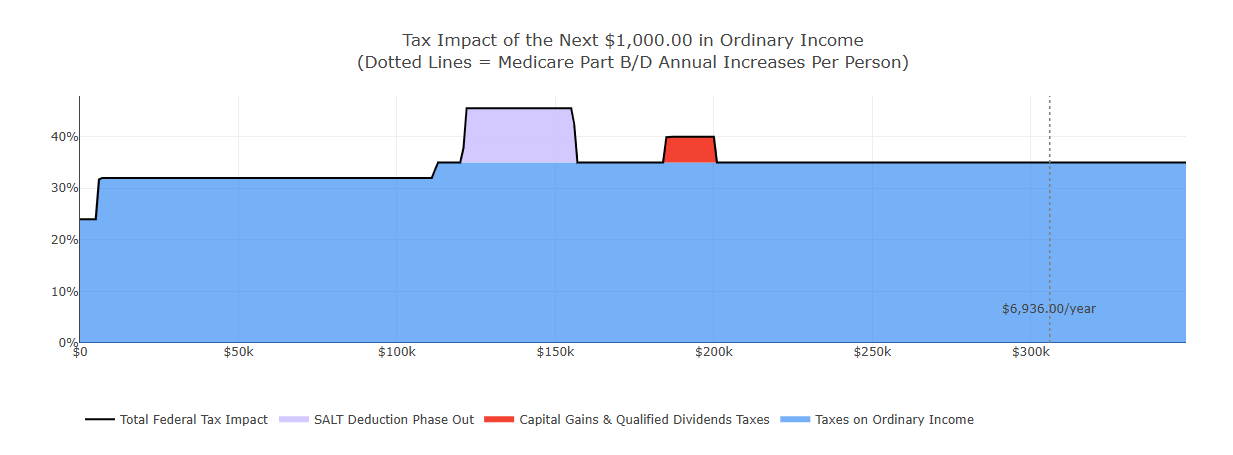

The image below is a part of a client’s tax projection to illustrate the potential tax impact of a Roth conversion. To help us determine how much to convert to a Roth IRA, we charted the tax impact of each additional $1,000 of ordinary income created by the Roth conversion (X axis) to ensure we didn’t inadvertently trigger stealth taxes (Y axis). In this case, there were three that we needed to consider :

- State and local tax (SALT) phaseout: If we converted $120k-$155k, the effective tax rate would have skyrocketed from 35% (the marginal rate) to 45.5%. The tax increase results from the SALT deduction being phased out, which is equivalent to a 10.5% increase. We’re seeing this more often now that the new OBBA increased the SALT cap to $40,000 (from $10,000), leading to more people itemizing their deductions.

- Capital gains and qualified dividends tax increase: Starting at $185k of additional income, this client's capital gains tax rates increase from 15% to 20% (a 5% jump), resulting in a 40% effective tax rate.

- Medicare premium increases (i.e., IRMAA): With a $305k Roth conversion, this client would get bumped into the fifth IRMAA bracket (vertical dotted line), increasing their annual Part B and D premiums by $6,936 over the base premium.

While these additional taxes won’t derail a retirement income plan, they do increase the cost of a Roth conversion and are typically avoidable. With some planning, you can avoid nasty surprises come tax time.

2.) Paying Taxes From Your IRA

While not necessarily a mistake, withholding taxes from your Roth conversion can be a huge missed opportunity to maximize the benefits of the conversion. This is because paying the tax bill with cash held outside the IRA, such as in your bank or taxable brokerage account, allows you to shelter more funds in the Roth IRA, leading to more tax-free growth.

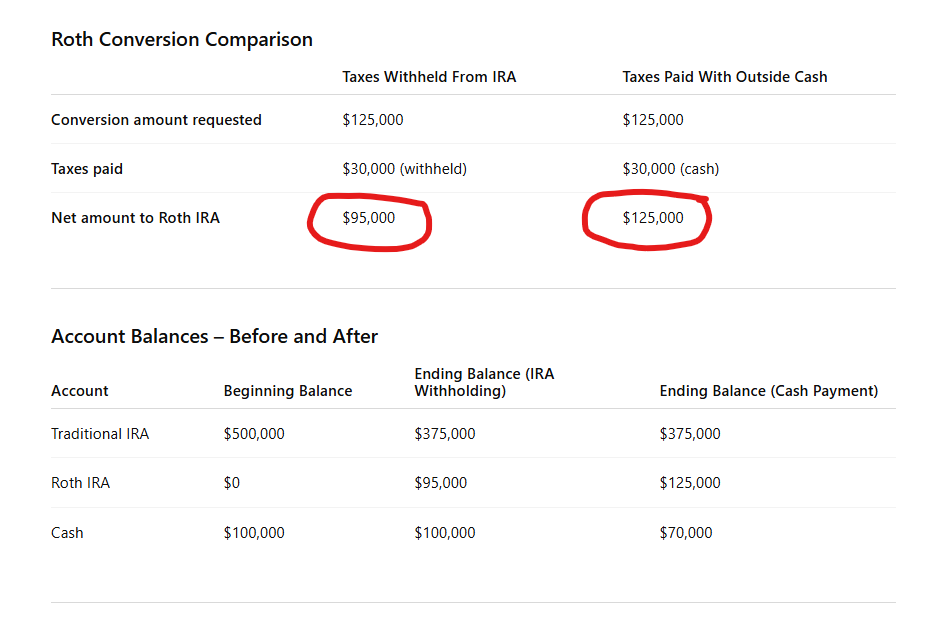

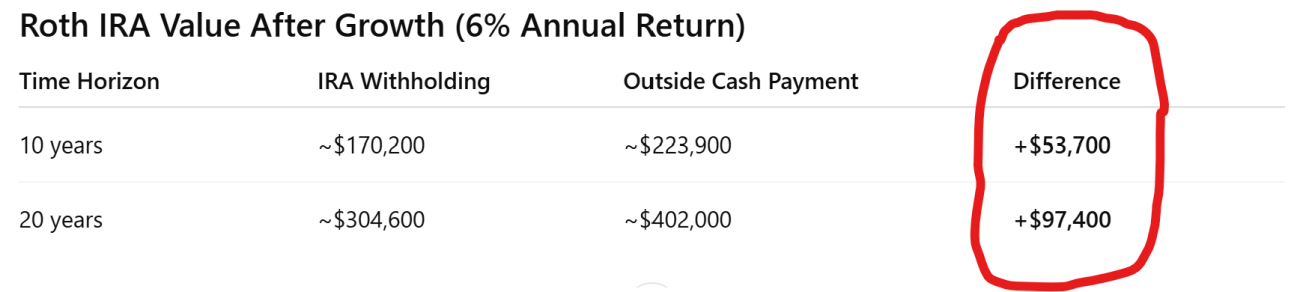

We show the ending account balances for both approaches below, assuming a $125,000 Roth Conversion and a $30,000 tax payment (24% rate).

To take it one step further, we can apply an investment return assumption to show tax-free growth over time for both scenarios. Of course, not everyone has the luxury of paying such a large tax bill from funds held outside their IRA, and Roth conversions remain beneficial even if you don’t. But if you do, the benefits are meaningful.

3.) Roth Converting Too Much

One aim of Roth conversions is to smooth your tax brackets throughout retirement. This can reduce your lifetime tax bill while often increasing the after-tax value of your investment accounts for your heirs, keeping more wealth in your family—a win-win. Smoothing your tax brackets is different from trying to move you into the lowest possible bracket in the future, which can result in an unnecessarily large tax bill.

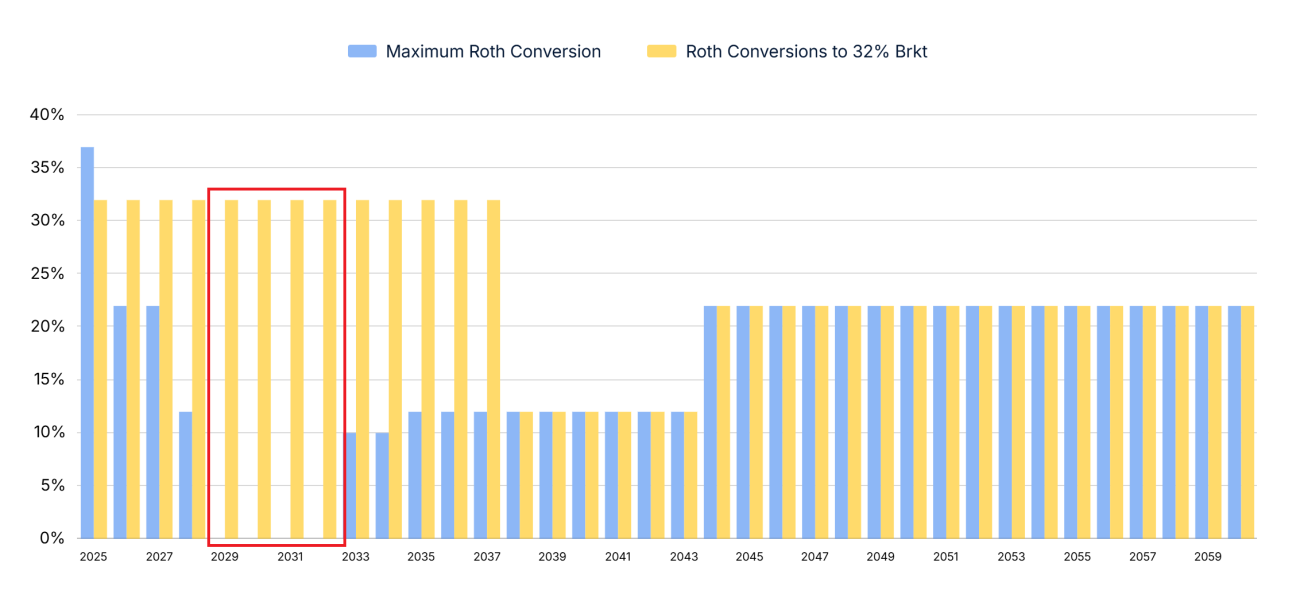

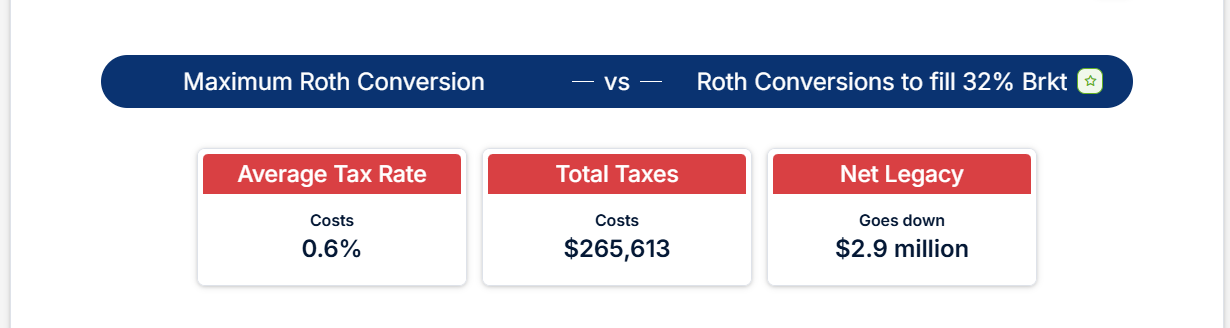

In the graph below, we show tax rate projections for two Roth conversion strategies over a 35-year retirement. The “Maximum” strategy assumes the retiree converts all of their traditional IRA to a Roth during the first year of retirement (2025), whereas the “32% Bracket” strategy entails systematically filling up the 32% tax bracket from 2025 -2037.

While both strategies eventually smooth out this retiree’s tax rates, converting the entire traditional IRA balance at once results in no taxable income for four years (as highlighted in the red box). While this may seem like a good thing, it’s a missed opportunity to take advantage of the Standard Deduction ($16,100 single and $32,200 married filing jointly in 2026), which is the income that’s taxed at a 0% rate, and pay taxes at the low 10% and 12% rates.

The difference between these two strategies is significant. By converting everything at once, lifetime taxes increase, and the after-tax account value at death (net legacy) declines, destroying substantial value. The takeaway is that more isn’t always better.

Ensure Your Roth Conversion Fits Into Your Retirement Plan

Roth conversions can unlock immense tax savings, but only when evaluated alongside all the moving parts of your retirement plan. What may seem like small, inconsequential decisions can either add or destroy thousands (or millions) of dollars in value over a decades-long retirement. But with a thoughtful plan, most pitfalls are avoidable.

If you’d like the guidance of a retirement planning specialist as you evaluate your Roth conversion plans, you can schedule your complementary Thrive assessment with one of our retirement planning specialists here.