What You Should Know About Roth Conversions in 2026 and Beyond

TAKEAWAYS:

- Roth conversions remain fully available in 2026 and beyond, but recent tax law changes have made the planning more nuanced.

- The true cost of a Roth conversion is no longer just about tax brackets—it now depends heavily on deductions, phaseouts, and other income-based thresholds.

- Strategic Roth conversions can still add significant long-term value when sized and timed carefully as part of a broader retirement plan.

A Roth conversion is the process of transferring all or a part of your existing pre-tax retirement account balance (e.g., traditional IRA, 401(k), etc.) to an after-tax Roth retirement account, like a Roth IRA, Roth 401(k), etc. While the IRS has imposed income limitations that prevent high earners from contributing directly to Roth IRAs, there are no limits on the amount of assets that can be converted to a Roth account. But keep in mind that any assets converted to a Roth account are taxed as “ordinary income” (just like employment earnings) in the year of the conversion.

As retirement planning specialists, we help our clients determine whether a Roth conversion could help them achieve their goals. In doing so, we often see many misconceptions about how to do a Roth conversion properly. And now, with the latest passing of the One Big Beautiful Bill, it’s even more important to understand the latest rules to ensure that a Roth conversion doesn’t negatively affect your financial plan. Here’s what to be aware of as you consider doing a Roth conversion in 2026 and beyond.

How Tax Law Changes Affect Roth Conversions After 2025

Under the One Big Beautiful Bill Act (OBBBA), many of the individual income tax provisions originally set to expire after 2025 have been extended. As a result, the widely discussed “tax rate cliff” in 2026 is no longer the primary driver of Roth conversion decisions.

A multi-year Roth conversion strategy may still make sense, but instead of simply “filling up” a tax bracket, the goal is often to convert up to the point where additional income begins to trigger higher effective taxes—such as deduction phaseouts, Medicare premium surcharges, or other income-based thresholds.

Why the New Deduction and Phase-out Numbers Matter

At first glance, expanded tax breaks may seem to create additional room for Roth conversions. But once income crosses certain thresholds, those deductions can begin to shrink or disappear altogether.

For tax year 2026, the state and local tax (SALT) itemized deduction cap is $40,400. And if your modified adjusted gross income (MAGI) exceeds certain thresholds — about $505,000 for joint filers in 2026 — the SALT deduction begins to phase out and caps out at the $606,000 income level to the original TCJA floor of $10,000.

For example, assume a married couple filing jointly has $475,000 of modified adjusted gross income (MAGI) in 2026 and is fully benefiting from the $40,400 SALT deduction. If they complete a $100,000 Roth conversion, their MAGI increases to $575,000, pushing them into the SALT phase-out range.

As their income rises through the phase-out, a portion of their SALT deduction is reduced. That lost deduction increases taxable income beyond the Roth conversion itself, effectively raising the true tax cost of the conversion. At a 22% marginal tax rate, every $10,000 of lost SALT deduction adds an additional $2,200 to their federal tax bill on top of the tax owed on the converted amount.

The Benefits of Roth Conversion in 2026 and Beyond

The benefits of doing a Roth conversion remain the same as before, with the biggest benefit being that you could pay income taxes now at a lower rate than later at potentially higher rates if the tax law changes in the future and tax rates increase.

Additionally, there are many strategic benefits to doing Roth conversions as part of your overall retirement planning and tax planning process.

1. Tax-Efficient Retirement Distributions

Having assets invested in a Roth IRA in addition to an IRA allows you to coordinate withdrawals later to keep yourself just under your highest marginal income tax bracket. For example (ignoring exemptions and other income), assume in 2026 you needed $150,000 from your IRA to help fund your living expenses.

Based on the 2026 tax brackets, your marginal income tax rate would be 22% if married filing jointly. You would pay 10% on your first $24,800, 12% on the next $76,000, and finally 22% on your last $49,200. Altogether, your tax bill would be $22,424. But if you funded that last $49,200 from your Roth IRA instead of your traditional IRA, you would reduce your tax bill by $10,824! Having sufficient assets in a Roth IRA allows you to create an optimal tax-efficient strategy of ongoing withdrawal coordination to minimize the taxes you pay over your lifetime.

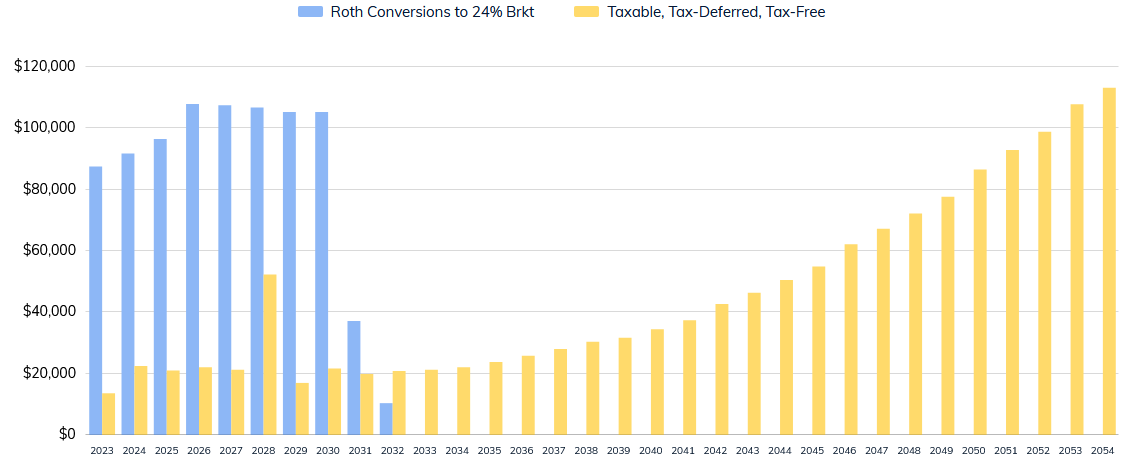

As an example, we have a client that has started converting some of their Roth back in 2023, under the prior rules so that beginning in 2031, they have enough money in their Roth IRAs to fund their $150,000 net retirement spending goal while staying in (or below) the second lowest tax bracket. Following is a comparison of the couple’s estimated yearly tax liability under their Roth conversion strategy (in blue) and a no-Roth strategy (in yellow) based on the rules before the OBBA. While the exact numbers of how much the couple will save may now be different, the core principles and benefits of a Roth conversion are still applicable even with today’s rules.

2. Reduce Your Required Minimum Distributions

Another less obvious benefit of a properly constructed Roth conversion strategy is that you can lower the amount of your future RMDs (required minimum distributions). By converting your IRA assets to a Roth IRA, you reduce the amount left in your traditional IRA accounts and transfer the assets’ future growth. By lowering the amount of assets in your traditional IRA, you can lower your RMD so that you do not have to recognize income and pay taxes on money that may not be needed. Reducing RMDs is also an essential strategy for lowering your sequence of returns risk.

Carrying forward our previous example, the following compares the couple’s forecasted RMDs under their Roth conversion strategy (top) and a no-Roth strategy (bottom).

Projected RMDs with Roth conversions (pink bars represent RMD income).

Projected RMDs without Roth conversions (pink bars represent RMD income).

3. Tax-Efficiently Passing Money to Beneficiaries

A Roth IRA conversion strategy can also tax-efficiently pass more wealth on to beneficiaries. If you were to leave your traditional IRA assets to your beneficiaries, the IRS would require them to take required minimum distributions (RMDs) annually and ensure the entire account was depleted within ten years from the date of your death, paying income taxes on all the amounts withdrawn. There might be two problems with this.

First, your beneficiaries might be in a higher marginal income tax bracket than you are, given they are still in their working years. Second, your beneficiaries must pay taxes on the assets' ten years of capital growth. If your beneficiaries are in higher marginal income tax brackets than you, paying taxes at your lower rate by converting the assets to a Roth IRA allows the assets to pass and not be taxed at your beneficiaries' higher tax rate later. Additionally, the assets not withdrawn for RMDs can grow tax-free for ten years. The result could be more wealth passing to your beneficiaries.

4. Asset Location

Lastly, a Roth account provides a more robust way to execute an investment management strategy known as “asset location.” The idea behind asset location is that holding certain types of assets in certain types of accounts is advantageous.

You can view all your assets and accounts as one aggregate portfolio rather than creating a balanced portfolio in every account. When viewed in this aggregate way, you can take advantage of the fact that capital growth assets, like stocks, are best held in Roth accounts. Why? Because stocks have the most expected growth, and that growth will never again be taxed if held in a Roth IRA. Having bonds in a Roth IRA account would waste that account type's tax advantage. Income-producing assets, like bonds and REITs, are best held in retirement accounts, so their income distribution can grow tax-deferred rather than become immediately taxable as they would if held in a taxable account.

Be Aware of the December 31st Deadline

There are many factors to consider and some common mistakes to avoid when developing a Roth conversion strategy. The strategy must be constructed based on a couple’s (or individual’s) unique circumstances, resources, and goals.

Although contributions to an IRA or a Roth IRA can be made by the tax filing deadline, Roth conversions must always be made by December 31st. Not only do Roth IRA conversion requests have to be completed by year-end, but processing times also need to be considered. Because retirement account custodians tend to get flooded with paperwork before year-end, we strive to have all client Roth conversion requests in by November 30th to ensure timely processing.

Consult a Retirement Planning Specialist Before Considering a Roth Conversion in 2026

While expanded deductions and higher SALT limits under the OBBBA may lower taxes for some households, Roth conversions increase modified adjusted gross income (MAGI), which can unintentionally reduce or eliminate those same benefits.

Higher income from a conversion can push you into phase-out ranges that affect deductions such as SALT, senior deductions, or other income-based benefits. This could raise your effective tax rate even if your marginal bracket stays the same. Because of the additional complexity that the new law brings, it may be a good idea to consult with a retirement planning specialist and a tax advisor before doing a Roth conversion in 2026 or beyond.

If you would like some guidance in figuring out if a Roth conversion would benefit you, schedule a complimentary call with one of our retirement planning specialists here to get started so we can model your situation and guide you through the decision.